Home

Home

Back

Back

Definition: This calculator computes the net operating working capital (\( NOWC \)), which represents the difference between a company's current operating assets and current operating liabilities, reflecting short-term operational funding needs.

Purpose: Helps businesses and investors assess the liquidity and operational efficiency of short-term assets and liabilities, excluding non-operating items.

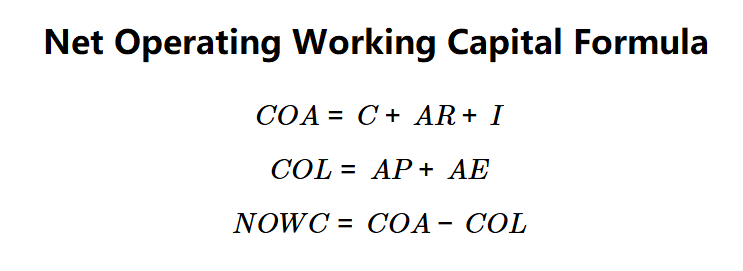

The calculator follows a three-step process to compute \( NOWC \):

Formulas:

Steps:

Calculating \( NOWC \) is crucial for:

Example 1 (Company Alpha): \( C = \$1,000 \), \( AR = \$15,000 \), \( I = \$5,000 \), \( AP = \$18,000 \), \( AE = \$2,000 \):

A NOWC of $1,000 indicates a slight positive working capital for Company Alpha.

Example 2: \( C = \$5,000 \), \( AR = \$10,000 \), \( I = \$8,000 \), \( AP = \$12,000 \), \( AE = \$3,000 \):

A NOWC of $8,000 reflects a healthy operational liquidity buffer.

Example 3: \( C = \$2,000 \), \( AR = \$5,000 \), \( I = \$3,000 \), \( AP = \$7,000 \), \( AE = \$4,000 \):

A negative NOWC of -$1,000 indicates current liabilities exceed current assets, suggesting potential liquidity issues.

Q: What is net operating working capital?

A: Net operating working capital (\( NOWC \)) is the net amount of current assets minus current liabilities used in a company's core operations.

Q: Why exclude non-operating items?

A: Excluding non-operating items like excess cash or long-term debt focuses the calculation on operational liquidity needs.

Q: Can NOWC be negative?

A: Yes, a negative \( NOWC \) occurs when current operating liabilities exceed current operating assets, indicating potential short-term funding gaps.