Home

Home

Back

Back

Definition: This calculator computes the Net Operating Income (NOI), the annual profit from a real estate property after accounting for rental income and operating expenses, excluding debt service and capital expenditures.

Purpose: Helps property owners and investors evaluate a property’s financial performance, assess investment viability, and compare properties.

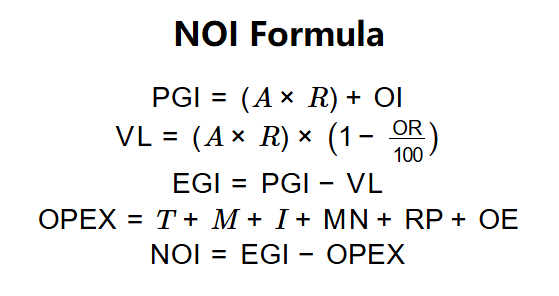

The calculator uses the following formulas:

Formulas:

Steps:

Calculating NOI is key for:

Example: For a property with \( A = 1,500 \text{ sq ft} \), \( R = \$300 \text{ per sq ft/year} \), \( \text{OI} = \$2,000 \), \( \text{OR} = 85\% \), and expenses (\( T = \$20,000 \), \( M = \$14,000 \), \( I = \$19,500 \), \( \text{MN} = \$18,000 \), \( \text{RP} = \$24,500 \), \( \text{OE} = \$17,000 \)):

Q: How do I calculate NOI?

A: NOI is calculated in four steps: (1) Compute PGI (\( A \times R + \text{OI} \)); (2) Subtract VL to get EGI; (3) Sum OPEX (\( T + M + I + \text{MN} + \text{RP} + \text{OE} \)); (4) Subtract OPEX from EGI. For example, a 1,500 sq ft property with $300/sq ft rent, $2,000 parking, 85% occupancy, and $113,000 expenses yields NOI = $271,500.

Q: What expenses are included in OPEX?

A: OPEX includes property tax, management fees, insurance, maintenance, repairs, and other operating costs, but excludes debt service and capital expenditures.

Q: Why is NOI important for investors?

A: NOI measures profitability, aiding in performance assessment, property comparison, and valuation using the capitalization rate.