Home

Home

Back

Back

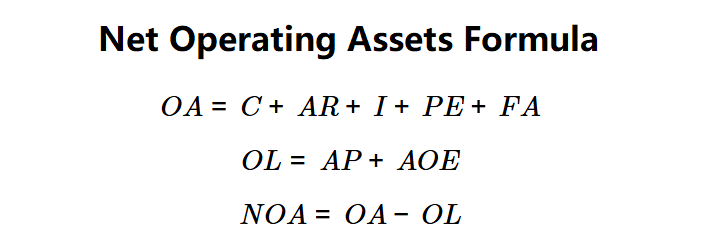

Definition: This calculator computes the net operating assets (\( NOA \)), which represents the difference between a company's operating assets and operating liabilities, reflecting the capital employed in its core operations.

Purpose: Helps businesses and investors evaluate the operational capital structure, assess efficiency, and support financial analysis such as return on net operating assets (RNOA).

The calculator follows a three-step process to compute \( NOA \):

Formulas:

Steps:

Calculating \( NOA \) is crucial for:

Example 1 (Company Alpha): \( C = \$250,000 \), \( AR = \$200,000 \), \( I = \$400,000 \), \( PE = \$100,000 \), \( FA = \$1,000,000 \), \( AP = \$450,000 \), \( AOE = \$1,200,000 \):

A NOA of $300,000 indicates the net operational capital for Company Alpha.

Example 2: \( C = \$100,000 \), \( AR = \$150,000 \), \( I = \$300,000 \), \( PE = \$50,000 \), \( FA = \$800,000 \), \( AP = \$200,000 \), \( AOE = \$400,000 \):

A NOA of $800,000 reflects a higher operational capital base.

Example 3: \( C = \$300,000 \), \( AR = \$100,000 \), \( I = \$200,000 \), \( PE = \$50,000 \), \( FA = \$500,000 \), \( AP = \$350,000 \), \( AOE = \$900,000 \):

A negative NOA of -$100,000 indicates operating liabilities exceed operating assets.

Q: What are net operating assets?

A: Net operating assets (\( NOA \)) is the net value of assets used in a company's core operations, excluding non-operating items.

Q: Why include cash in operating assets?

A: Cash is included as it supports day-to-day operations, though some analyses may exclude it for specific metrics.

Q: Can NOA be negative?

A: Yes, a negative \( NOA \) occurs when operating liabilities exceed operating assets, signaling potential financial strain.