1. What is the Net Income Calculator?

Definition: This calculator computes the net income (\( NI \)) and related metrics (gross profit, operating income, net income before taxes, and profit taxes), which represent a company's profitability after all expenses and taxes.

Purpose: Helps businesses and investors assess financial performance, plan budgets, and evaluate the impact of costs and taxes on profitability.

2. How Does the Calculator Work?

The calculator follows a four-step process to compute net income and intermediate values:

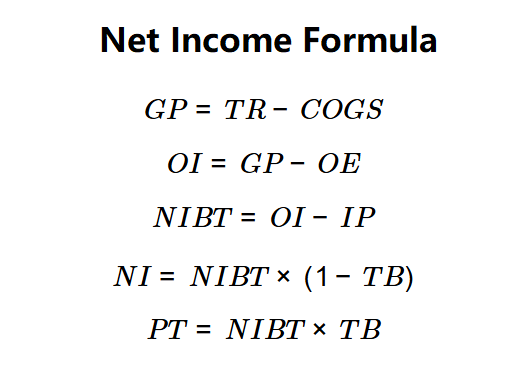

Formulas:

$$ GP = TR - COGS $$

$$ OI = GP - OE $$

$$ NIBT = OI - IP $$

$$ NI = NIBT \times (1 - TB) $$

$$ PT = NIBT \times TB $$

Where:

- \( GP \): Gross Profit (dollars)

- \( OI \): Operating Income (dollars)

- \( NIBT \): Net Income Before Taxes (dollars)

- \( NI \): Net Income (dollars)

- \( PT \): Profit Taxes (dollars)

- \( TR \): Total Revenue (dollars)

- \( COGS \): Cost of Goods Sold (dollars)

- \( OE \): Operating Expenses (dollars)

- \( IP \): Interest Paid (dollars)

- \( TB \): Tax Bracket (decimal)

Steps:

- Step 1: Determine \( TR \) and \( COGS \). Input the total revenue and cost of goods sold from the income statement.

- Step 2: Calculate \( GP \). Subtract \( COGS \) from \( TR \).

- Step 3: Determine \( OE \). Input the operating expenses from the income statement.

- Step 4: Calculate \( OI \). Subtract \( OE \) from \( GP \).

- Step 5: Determine \( IP \). Input the interest paid from the financial statements.

- Step 6: Calculate \( NIBT \). Subtract \( IP \) from \( OI \).

- Step 7: Determine \( TB \). Input the tax bracket as a percentage.

- Step 8: Calculate \( PT \). Multiply \( NIBT \) by \( TB \).

- Step 9: Calculate \( NI \). Multiply \( NIBT \) by \( (1 - TB) \).

Note: If operating expenses exceed gross profit, net income may be negative, indicating a loss.

3. Importance of Net Income Calculation

Calculating net income and related metrics is crucial for:

- Profitability Assessment: Provides a clear picture of a company's bottom-line profit after all costs.

- Financial Planning: Helps in budgeting and forecasting future earnings.

- Investment Analysis: Assists investors in evaluating a company's financial health.

4. Using the Calculator

Example 1:

\( TR = \$100,000 \), \( COGS = \$40,000 \), \( OE = \$20,000 \), \( IP = \$5,000 \), \( TB = 30\% \):

- Step 1: \( TR = \$100,000 \), \( COGS = \$40,000 \).

- Step 2: \( GP = 100,000 - 40,000 = \$60,000 \).

- Step 3: \( OE = \$20,000 \).

- Step 4: \( OI = 60,000 - 20,000 = \$40,000 \).

- Step 5: \( IP = \$5,000 \).

- Step 6: \( NIBT = 40,000 - 5,000 = \$35,000 \).

- Step 7: \( TB = 30\% = 0.30 \).

- Step 8: \( PT = 35,000 \times 0.30 = \$10,500 \).

- Step 9: \( NI = 35,000 \times (1 - 0.30) = 35,000 \times 0.70 = \$24,500 \).

- Results: \( GP = \$60,000 \), \( OI = \$40,000 \), \( NIBT = \$35,000 \), \( NI = \$24,500 \), \( PT = \$10,500 \).

A net income of $24,500 indicates profitability after taxes.

Example 2:

\( TR = \$50,000 \), \( COGS = \$30,000 \), \( OE = \$25,000 \), \( IP = \$3,000 \), \( TB = 25\% \):

- Step 1: \( TR = \$50,000 \), \( COGS = \$30,000 \).

- Step 2: \( GP = 50,000 - 30,000 = \$20,000 \).

- Step 3: \( OE = \$25,000 \).

- Step 4: \( OI = 20,000 - 25,000 = \$-5,000 \).

- Step 5: \( IP = \$3,000 \).

- Step 6: \( NIBT = -5,000 - 3,000 = \$-8,000 \).

- Step 7: \( TB = 25\% = 0.25 \).

- Step 8: \( PT = -8,000 \times 0.25 = \$-2,000 \).

- Step 9: \( NI = -8,000 \times (1 - 0.25) = -8,000 \times 0.75 = \$-6,000 \).

- Results: \( GP = \$20,000 \), \( OI = \$-5,000 \), \( NIBT = \$-8,000 \), \( NI = \$-6,000 \), \( PT = \$-2,000 \).

A net income of -$6,000 indicates a loss due to high operating expenses.

Example 3:

\( TR = \$200,000 \), \( COGS = \$80,000 \), \( OE = \$50,000 \), \( IP = \$10,000 \), \( TB = 40\% \):

- Step 1: \( TR = \$200,000 \), \( COGS = \$80,000 \).

- Step 2: \( GP = 200,000 - 80,000 = \$120,000 \).

- Step 3: \( OE = \$50,000 \).

- Step 4: \( OI = 120,000 - 50,000 = \$70,000 \).

- Step 5: \( IP = \$10,000 \).

- Step 6: \( NIBT = 70,000 - 10,000 = \$60,000 \).

- Step 7: \( TB = 40\% = 0.40 \).

- Step 8: \( PT = 60,000 \times 0.40 = \$24,000 \).

- Step 9: \( NI = 60,000 \times (1 - 0.40) = 60,000 \times 0.60 = \$36,000 \).

- Results: \( GP = \$120,000 \), \( OI = \$70,000 \), \( NIBT = \$60,000 \), \( NI = \$36,000 \), \( PT = \$24,000 \).

A net income of $36,000 reflects strong profitability after a higher tax rate.

5. Frequently Asked Questions (FAQ)

Q: What is net income?

A: Net income (\( NI \)) is the total profit after subtracting all expenses, including taxes, from total revenue.

Q: Why might net income be negative?

A: A negative \( NI \) occurs when operating expenses or other costs exceed gross profit and interest income.

Q: How does tax bracket affect net income?

A: A higher \( TB \) reduces \( NI \) by increasing \( PT \), lowering the after-tax profit.

Home

Home

Back

Back