1. What is the Net Effective Rent Calculator?

Definition: This calculator computes the Net Effective Rent (NER), the average monthly rent paid over a lease term, accounting for discounts like rent-free months, tenant cash allowances, and operational costs.

Purpose: Helps landlords and tenants evaluate the true cost of a lease, factoring in incentives and expenses, to make informed rental decisions.

2. How Does the Calculator Work?

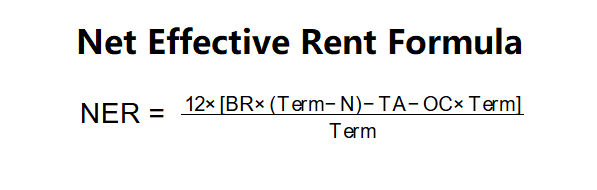

The calculator uses the following formula:

Formula:

\( \text{NER} = \frac{12 \times \left[ \text{BR} \times (\text{Term} - \text{N}) - \text{TA} - \text{OC} \times \text{Term} \right]}{\text{Term}}\)

Where:

- \( \text{BR} \): Base rent per month (USD)

- \( \text{Term} \): Lease term (months)

- \( \text{N} \): Number of rent-free months

- \( \text{TA} \): Tenant cash allowance (USD)

- \( \text{OC} \): Operational costs per month (USD)

Steps:

- Step 1: Input values. Enter base rent (\( \text{BR} \)), lease term (\( \text{Term} \)), rent-free months (\( \text{N} \)), tenant allowance (\( \text{TA} \)), and operational costs (\( \text{OC} \)), either as a fixed amount or percentage of rent.

- Step 2: Compute NER. Calculate the yearly NER using the formula, then divide by 12 for monthly NER.

- Step 3: Optional area-based calculation. If enabled, divide NER by property area to get NER per m².

3. Importance of NER Calculation

Calculating NER is key for:

- Lease Comparison: Allows tenants to compare leases by accounting for incentives and costs.

- Budget Planning: Helps tenants understand the true cost of renting over the lease term.

- Negotiation: Assists landlords in structuring competitive lease terms with appropriate discounts.

4. Using the Calculator

Example: For a property with \( \text{BR} = \$3,200 \), \( \text{Term} = 24 \text{ months} \), \( \text{N} = 1 \text{ month} \), \( \text{TA} = \$4,000 \), \( \text{OC} = \$256 \):

- Step 1: Input values.

- Step 2: Compute NER:

- \( \text{NER} = \frac{12 \times \left[ 3,200 \times (24 - 1) - 4,000 - 256 \times 24 \right]}{24} \)

- \( = \frac{12 \times \left[ 73,600 - 4,000 - 6,144 \right]}{24} = \frac{12 \times 63,456}{24} = \$31,728 \text{ per year} \)

- \( \text{Monthly NER} = \frac{31,728}{12} = \$2,644 \)

- Step 3: If area = 80 m², then:

- \( \text{NER per m² (yearly)} = \frac{31,728}{80} = \$396.60 \text{ per m² per year} \)

- \( \text{NER per m² (monthly)} = \frac{2,644}{80} = \$33.05 \text{ per m² per month} \)

- Result: Monthly NER = \$2,644, Yearly NER = \$31,728, NER per m² = \$33.05/month or \$396.60/year.

5. Frequently Asked Questions (FAQ)

Q: How do I calculate net effective rent?

A: NER is calculated by accounting for base rent, lease term, rent-free months, tenant allowances, and operational costs, using the formula: \( \text{NER} = \frac{12 \times \left[ \text{BR} \times (\text{Term} - \text{N}) - \text{TA} - \text{OC} \times \text{Term} \right]}{\text{Term}} \). For example, with \( \text{BR} = \$3,200 \), \( \text{Term} = 24 \), \( \text{N} = 1 \), \( \text{TA} = \$4,000 \), \( \text{OC} = \$256 \), NER = \$2,644/month.

Q: Why is NER lower than base rent?

A: NER accounts for discounts like rent-free months and cash allowances, as well as operational costs, reducing the effective rent compared to the nominal base rent.

Q: How does area-based NER help?

A: Dividing NER by property area provides the rent per square meter, making it easier to compare properties of different sizes.

Net Effective Rent Calculator© - All Rights Reserved 2025

Home

Home

Back

Back