1. What is the NSFR Calculator?

Definition: The NSFR Calculator measures a bank's net stable funding ratio, ensuring long-term funding stability under Basel III guidelines.

Purpose: Helps banks and regulators assess funding stability and compliance with regulatory requirements.

2. How Does the Calculator Work?

The calculator computes the NSFR using the following formula and steps:

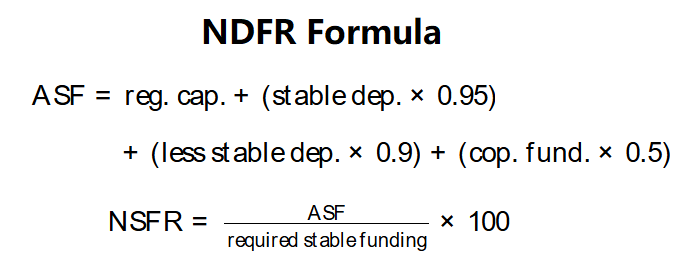

Formula:

\( \text{ASF} = \text{reg. cap.} + (\text{stable dep.} \times 0.95) + (\text{less stable dep.} \times 0.9) + (\text{cop. fund.} \times 0.5) \)

\( \text{NSFR} = \frac{\text{ASF}}{\text{required stable funding}} \times 100 \)

Where:

- \( \text{ASF} \): Available stable funding (dollars)

- \( \text{reg. cap.} \): Regulatory capital (dollars)

- \( \text{stable dep.} \): Stable demand deposits (dollars)

- \( \text{less stable dep.} \): Less stable demand deposits (dollars)

- \( \text{cop. fund.} \): Funding from corporations (dollars)

- \( \text{required stable funding} \): Required stable funding (dollars)

Steps:

- Step 1: Calculate Available Stable Funding (ASF). Add regulatory capital, 95% of stable demand deposits, 90% of less stable demand deposits, and 50% of corporate funding.

- Step 2: Determine Required Stable Funding. Input the amount of stable funding required by the bank.

- Step 3: Calculate NSFR. Divide ASF by required stable funding and multiply by 100.

3. Importance of NSFR Calculation

Calculating the NSFR is crucial for:

- Funding Stability: Ensures banks maintain sufficient stable funding over a one-year horizon.

- Regulatory Compliance: Meets Basel III minimum NSFR requirement (100% or higher).

- Risk Management: Identifies potential funding risks during economic stress.

4. Using the Calculator

Example (Bank Alpha):

Regulatory capital = $10,000,000, Stable demand deposits = $15,000,000, Less stable demand deposits = $10,000,000, Funding from corporations = $17,000,000, Required stable funding = $35,000,000:

- Step 1: ASF = $10,000,000 + ($15,000,000 \times 0.95) + ($10,000,000 \times 0.9) + ($17,000,000 \times 0.5) = $41,750,000.

- Step 2: Required stable funding = $35,000,000.

- Step 3: \( \text{NSFR} = \frac{41,750,000}{35,000,000} \times 100 \approx 119.29\% \).

- Results: ASF = $41,750,000, NSFR = 119.29%.

This indicates Bank Alpha exceeds the minimum NSFR requirement.

5. Frequently Asked Questions (FAQ)

Q: What is the NSFR?

A: The NSFR is a ratio that ensures banks have enough stable funding to support assets and activities over a one-year period.

Q: Why are ASF factors different?

A: ASF factors reflect the stability of funding sources, with higher factors for more reliable sources like regulatory capital.

Q: What does an NSFR above 100% mean?

A: It indicates the bank has more stable funding than required, suggesting financial resilience.

Home

Home

Back

Back