1. What is the Net Asset Value (NAV) Calculator?

Definition: This calculator computes the Net Asset Value (NAV) of an investment fund, representing the total value of its assets minus liabilities, and the NAV per share, indicating the value of each share.

Purpose: Helps investors assess the value of mutual funds, ETFs, or other investment funds, aiding in investment decisions and performance evaluation.

2. How Does the Calculator Work?

The calculator follows a three-step process to compute the NAV and NAV per share:

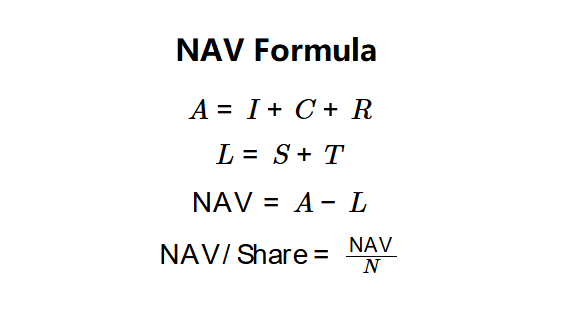

NAV Formulas:

\( A = I + C + R \)

\( L = S + T \)

\( \text{NAV} = A - L \)

\( \text{NAV/Share} = \frac{\text{NAV}}{N} \)

Where:

- \( A \): Fund Assets (dollars)

- \( I \): Total Investments (dollars)

- \( C \): Cash and Cash Equivalents (dollars)

- \( R \): Accounts Receivable (dollars)

- \( L \): Fund Liabilities (dollars)

- \( S \): Short-term Liabilities (dollars)

- \( T \): Long-term Liabilities (dollars)

- \( N \): Number of Shares Outstanding (shares)

Steps:

- Step 1: Calculate fund assets (\( A \)). Sum the total investments (\( I \)), cash (\( C \)), and receivables (\( R \)).

- Step 2: Calculate fund liabilities (\( L \)). Sum the short-term (\( S \)) and long-term liabilities (\( T \)).

- Step 3: Calculate NAV and NAV per share. Subtract liabilities (\( L \)) from assets (\( A \)) to get NAV, then divide by shares (\( N \)).

3. Importance of Net Asset Value

Calculating NAV is crucial for:

- Fund Valuation: Provides a snapshot of a fund’s net worth, reflecting its financial health.

- Investment Decisions: Helps investors determine the price per share for buying or selling fund units.

- Performance Tracking: Allows comparison of fund performance over time or against other funds.

4. Using the Calculator

Example (Fund Alpha): \( I = \$1,500,000 \), \( C = \$250,000 \), \( R = \$75,000 \), \( S = \$450,000 \), \( T = \$600,000 \), \( N = 200,000 \):

- Step 1: Fund Assets: \( A = 1,500,000 + 250,000 + 75,000 = 1,825,000 \) dollars

- Step 2: Fund Liabilities: \( L = 450,000 + 600,000 = 1,050,000 \) dollars

- Step 3: NAV: \( \text{NAV} = 1,825,000 - 1,050,000 = 775,000 \) dollars

- NAV per Share: \( \text{NAV/Share} = \frac{775,000}{200,000} = 3.88 \) dollars/share

- Result: NAV = $775,000.00, NAV per Share = $3.88

Example 2: \( I = \$2,000,000 \), \( C = \$300,000 \), \( R = \$50,000 \), \( S = \$500,000 \), \( T = \$700,000 \), \( N = 250,000 \):

- Step 1: Fund Assets: \( A = 2,000,000 + 300,000 + 50,000 = 2,350,000 \) dollars

- Step 2: Fund Liabilities: \( L = 500,000 + 700,000 = 1,200,000 \) dollars

- Step 3: NAV: \( \text{NAV} = 2,350,000 - 1,200,000 = 1,150,000 \) dollars

- NAV per Share: \( \text{NAV/Share} = \frac{1,150,000}{250,000} = 4.60 \) dollars/share

- Result: NAV = $1,150,000.00, NAV per Share = $4.60

Example 3: \( I = \$800,000 \), \( C = \$100,000 \), \( R = \$20,000 \), \( S = \$200,000 \), \( T = \$300,000 \), \( N = 100,000 \):

- Step 1: Fund Assets: \( A = 800,000 + 100,000 + 20,000 = 920,000 \) dollars

- Step 2: Fund Liabilities: \( L = 200,000 + 300,000 = 500,000 \) dollars

- Step 3: NAV: \( \text{NAV} = 920,000 - 500,000 = 420,000 \) dollars

- NAV per Share: \( \text{NAV/Share} = \frac{420,000}{100,000} = 4.20 \) dollars/share

- Result: NAV = $420,000.00, NAV per Share = $4.20

5. Frequently Asked Questions (FAQ)

Q: What does a high NAV per share indicate?

A: A higher NAV per share suggests a fund has more net assets per share, but it should be compared within the same fund type or industry.

Q: Can NAV be negative?

A: Yes, if liabilities exceed assets, but this is rare and indicates financial distress in the fund.

Q: Why is NAV important for mutual funds?

A: NAV determines the price at which investors buy or sell mutual fund shares, reflecting the fund’s per-share value.

Net Asset Value (NAV) Calculator© - All Rights Reserved 2025

Home

Home

Back

Back