1. What is the Money Multiplier Calculator?

Definition: The Money Multiplier Calculator determines the expansion of the money supply based on checkable deposits, reserve requirements, and currency in circulation.

Purpose: Helps economists and central banks analyze the money creation process and its impact on the economy.

2. How Does the Calculator Work?

The calculator computes the money multiplier and related monetary aggregates using the following formulas and steps:

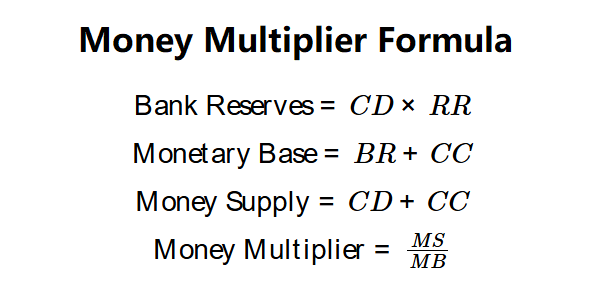

Formulas:

\( \text{Bank Reserves} = CD \times RR \)

\( \text{Monetary Base} = BR + CC \)

\( \text{Money Supply} = CD + CC \)

\( \text{Money Multiplier} = \frac{MS}{MB} \)

Where:

- \( CD \): Checkable deposit (dollars)

- \( RR \): Reserve ratio (% as decimal)

- \( BR \): Bank reserves (dollars)

- \( CC \): Currency in circulation (dollars)

- \( MB \): Monetary base (dollars)

- \( MS \): Money supply (dollars)

Steps:

- Step 1: Input Checkable Deposit. Enter the total checkable deposits.

- Step 2: Input Reserve Ratio. Enter the percentage of deposits banks must hold as reserves.

- Step 3: Input Currency in Circulation. Enter the amount of cash held by the public.

- Step 4: Calculate Bank Reserves. Multiply checkable deposit by reserve ratio.

- Step 5: Calculate Monetary Base. Add bank reserves and currency in circulation.

- Step 6: Calculate Money Supply. Add checkable deposit and currency in circulation.

- Step 7: Calculate Money Multiplier. Divide money supply by monetary base.

3. Importance of Money Multiplier Calculation

Calculating the money multiplier is crucial for:

- Monetary Policy: Guides central bank reserve adjustments.

- Economic Forecasting: Predicts money supply expansion from deposits.

- Financial Stability: Assesses the impact of currency in circulation on money creation.

4. Using the Calculator

Example:

Checkable deposit = $9,000, Reserve ratio = 10%, Currency in circulation = $1,000:

- Step 1: Checkable deposit = $9,000.

- Step 2: Reserve ratio = 10% (0.1).

- Step 3: Currency in circulation = $1,000.

- Step 4: Bank reserves = \( 9,000 \times 0.1 = 900 \) dollars.

- Step 5: Monetary base = \( 900 + 1,000 = 1,900 \) dollars.

- Step 6: Money supply = \( 9,000 + 1,000 = 10,000 \) dollars.

- Step 7: Money multiplier = \( \frac{10,000}{1,900} \approx 5.26 \).

- Results: Bank reserves = $900, Monetary base = $1,900, Money supply = $10,000, Money multiplier = 5.26.

This reflects the money creation potential in a simplified banking system.

5. Frequently Asked Questions (FAQ)

Q: What is the money multiplier?

A: The money multiplier is the ratio by which the money supply can expand based on the monetary base.

Q: How does currency in circulation affect the multiplier?

A: Higher currency in circulation reduces the multiplier by limiting deposit-based money creation.

Q: What is a typical reserve ratio?

A: Reserve ratios vary by country, often ranging from 0% to 10%, depending on central bank policy.

Home

Home

Back

Back