Home

Home

Back

Back

Definition: The Money Factor Calculator computes the money factor, a decimal value used in vehicle leasing to represent the financing cost, which can be converted to an equivalent annual percentage rate (APR).

Purpose: It helps lessees understand the interest component of lease payments, aiding in comparing leasing costs and negotiating better terms.

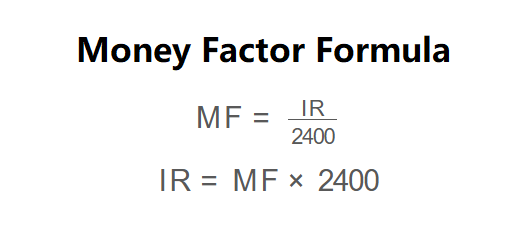

The calculator uses the following relationships:

\( \text{MF} = \frac{\text{IR}}{2400} \)

\( \text{IR} = \text{MF} \times 2400 \)

Where:

Steps:

Calculating the money factor is essential for:

Example 1: Calculate money factor for an interest rate of 20%:

Example 2: Calculate interest rate for a money factor of 0.004167:

Q: What is a good money factor?

A: A lower money factor (e.g., 0.00125, equivalent to 3% APR) is considered good, indicating lower financing costs.

Q: How is the 2400 multiplier derived?

A: It comes from 12 months × 200, a convention in the leasing industry to convert monthly interest to an annual rate.

Q: Can the money factor be negative?

A: No, the money factor should be positive, as it represents a cost of borrowing.