1. What is the Maturity Value Calculator?

Definition: This calculator computes the maturity value, the total value of an investment at the end of its term, including principal and compounded interest.

Purpose: Helps investors evaluate the future value of investments like bonds, fixed deposits, or savings accounts, aiding in financial planning.

2. How Does the Calculator Work?

The calculator follows a four-step process to compute the maturity value:

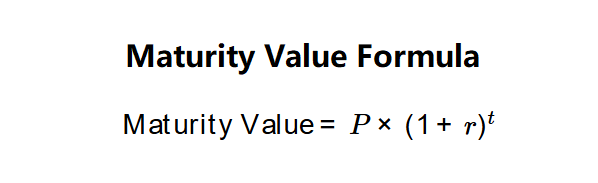

Maturity Value Formula:

\( \text{Maturity Value} = P \times (1 + r)^t \)

Where:

- \( P \): Principal amount (dollars)

- \( r \): Annual interest rate (decimal)

- \( t \): Time period (years)

Steps:

- Step 1: Determine the principal of the investment. This is the initial amount invested.

- Step 2: Calculate the interest rate of the investment. For bonds, this may be the yield to maturity (YTM).

- Step 3: Determine the time of investment. This is the duration until the investment matures.

- Step 4: Calculate the maturity value. Use the formula to compute the final value.

3. Importance of Maturity Value

Calculating maturity value is crucial for:

- Financial Planning: Estimates future value for goals like retirement or purchasing assets.

- Investment Comparison: Helps compare different investment options based on their final returns.

- Bond Investments: Provides insight into returns from bonds using yield to maturity.

4. Using the Calculator

Example: Principal = $2,000, Interest Rate = 3%, Time = 2 years:

- Step 1: Principal: $2,000

- Step 2: Interest Rate: 0.03

- Step 3: Time: 2 years

- Step 4: Maturity Value: \( 2,000 \times (1 + 0.03)^2 = 2,121.80 \) dollars

- Result: $2,121.80

Example 2: Principal = $5,000, Interest Rate = 4%, Time = 3 years:

- Step 1: Principal: $5,000

- Step 2: Interest Rate: 0.04

- Step 3: Time: 3 years

- Step 4: Maturity Value: \( 5,000 \times (1 + 0.04)^3 = 5,624.32 \) dollars

- Result: $5,624.32

Example 3: Principal = $10,000, Interest Rate = 5%, Time = 5 years:

- Step 1: Principal: $10,000

- Step 2: Interest Rate: 0.05

- Step 3: Time: 5 years

- Step 4: Maturity Value: \( 10,000 \times (1 + 0.05)^5 = 12,762.82 \) dollars

- Result: $12,762.82

5. Frequently Asked Questions (FAQ)

Q: What is yield to maturity (YTM) for bonds?

A: YTM is the total return anticipated on a bond if held until maturity, accounting for interest and price changes.

Q: Can maturity value be less than the principal?

A: No, with a positive interest rate, the maturity value will always be at least the principal.

Q: Why does time affect maturity value?

A: Longer investment periods allow more time for interest to compound, increasing the final value.

Maturity Value Calculator© - All Rights Reserved 2025

Home

Home

Back

Back