1. What is Market Capitalization Calculator?

Definition: This calculator computes the market capitalization, the total value of a company's outstanding shares.

Purpose: Helps investors assess a company's size and value, aiding in investment decisions and portfolio diversification.

2. How Does the Calculator Work?

The calculator uses the formula:

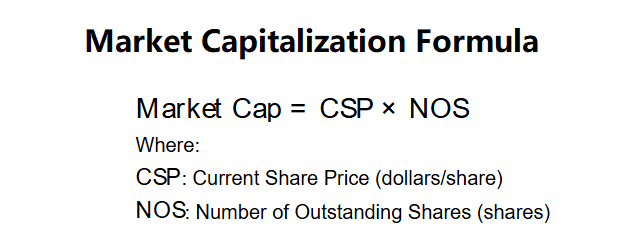

Market Capitalization Formula:

\( \text{Market Cap} = \text{CSP} \times \text{NOS} \)

Where:

- \( \text{CSP} \): Current Share Price (dollars/share)

- \( \text{NOS} \): Number of Outstanding Shares (shares)

Steps:

- Enter the current share price and number of outstanding shares.

- Multiply these values to calculate market capitalization.

- Display the result with 2 decimal places.

3. Importance of Market Capitalization

Calculating market capitalization is crucial for:

- Company Size: Classifies companies as large-cap, mid-cap, or small-cap based on value.

- Investment Strategy: Guides risk assessment and diversification across market segments.

- Market Insight: Reflects investor perception of a company’s worth and growth potential.

4. Using the Calculator

Example 1: CSP = $50, NOS = 20,000,000:

- Current Share Price: $50

- Number of Outstanding Shares: 20,000,000

- Market Capitalization: \( 50 \times 20,000,000 = 1,000,000,000 \) dollars

- Result: \( 1,000,000,000.00 \) dollars

Example 2: CSP = $32, NOS = 12,000,000:

- Current Share Price: $32

- Number of Outstanding Shares: 12,000,000

- Market Capitalization: \( 32 \times 12,000,000 = 384,000,000 \) dollars

- Result: \( 384,000,000.00 \) dollars

Example 3: CSP = $184, NOS = 12,000,000:

- Current Share Price: $184

- Number of Outstanding Shares: 12,000,000

- Market Capitalization: \( 184 \times 12,000,000 = 2,208,000,000 \) dollars

- Result: \( 2,208,000,000.00 \) dollars

5. Frequently Asked Questions (FAQ)

Q: What is a good market capitalization?

A: Depends on goals; large-cap (> $10B) for stability, small-cap ($300M - $2B) for growth, but compare within industries.

Q: How is outstanding shares determined?

A: From company financial reports, excluding treasury shares.

Q: Why does market cap change?

A: It fluctuates with share price, driven by supply, demand, and company performance.

Market Capitalization Calculator© - All Rights Reserved 2025

Home

Home

Back

Back