Home

Home

Back

Back

Definition: The Margin and VAT Calculator computes the profit margin, revenue, cost, or profit, incorporating Value Added Tax (VAT), based on any two known values, helping businesses assess profitability and pricing with tax considerations.

Purpose: This tool assists businesses in setting prices, understanding net and gross revenue, and evaluating financial efficiency while accounting for VAT obligations.

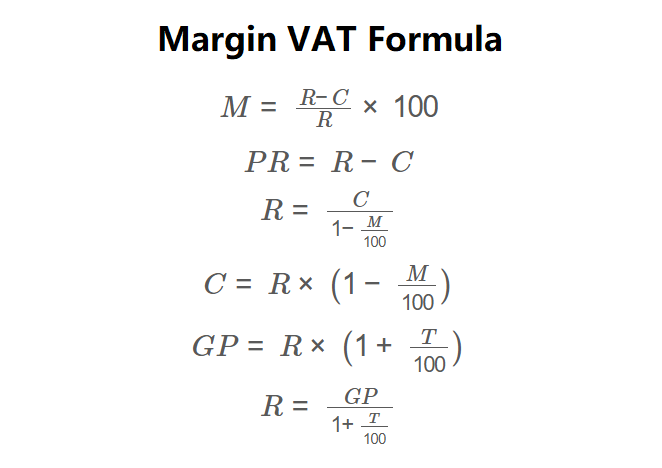

The calculator uses the following formulas:

\( M = \frac{R - C}{R} \times 100 \)

\( PR = R - C \)

\( R = \frac{C}{1 - \frac{M}{100}} \)

\( C = R \times \left(1 - \frac{M}{100}\right) \)

\( GP = R \times \left(1 + \frac{T}{100}\right) \)

\( R = \frac{GP}{1 + \frac{T}{100}} \)

Where:

Steps:

Calculating margin with VAT is essential for:

Example: Calculate the profit margin for a product with a cost of $50 and a gross price of $81.60, with a 20% VAT rate:

Q: What is profit margin?

A: Profit margin is the percentage of net revenue that remains as profit after subtracting the cost of goods sold, indicating business profitability.

Q: How does VAT affect pricing?

A: VAT increases the gross price paid by customers, requiring businesses to adjust net prices to achieve desired margins while covering tax obligations.

Q: How can businesses optimize profit margins?

A: Businesses can optimize margins by reducing costs, adjusting prices strategically, or negotiating better supplier terms while ensuring compliance with VAT regulations.