Home

Home

Back

Back

Definition: The Margin Interest Calculator computes the interest cost incurred when borrowing funds from a broker to invest in financial instruments, such as stocks or bonds.

Purpose: It helps investors understand the cost of trading on margin, aiding in financial planning and risk assessment.

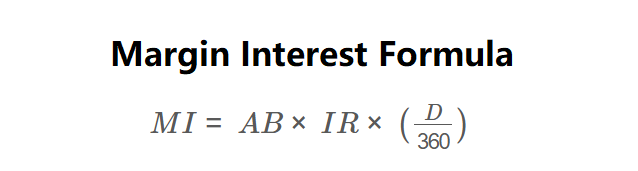

The calculator uses the following formula:

\( MI = AB \times IR \times \left(\frac{D}{360}\right) \)

Where:

Steps:

Calculating margin interest is essential for:

Example 1: Calculate margin interest for a $5,000 loan with a 7.5% interest rate over 30 days:

Example 2: Calculate for a $10,000 loan with a 6% interest rate over 60 days:

Q: What is margin interest?

A: Margin interest is the cost of borrowing funds from a broker to invest, calculated based on the borrowed amount, interest rate, and time held.

Q: Why is 360 used instead of 365?

A: The 360-day year is a banking convention that simplifies interest calculations, though some institutions may use 365 days.

Q: How can I reduce margin interest?

A: Reduce the borrowed amount, negotiate a lower interest rate, or shorten the holding period.