Home

Home

Back

Back

Definition: The MVA Calculator computes the Market Value Added (MVA), a financial metric that measures the difference between a company's current market value and the total capital invested by shareholders and bondholders.

Purpose: It helps investors and managers assess the value a company creates for its shareholders beyond the invested capital, indicating management effectiveness.

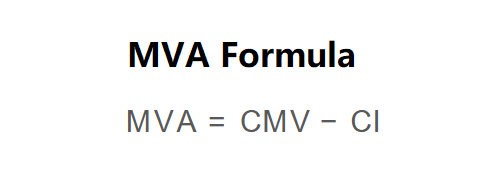

The calculator uses the following formula:

\( \text{MVA} = \text{CMV} - \text{CI} \)

Where:

Steps:

Calculating MVA is essential for:

Example 1: Calculate MVA for a company with a current share price of $50, 20,000 shares outstanding, and $700,000 capital invested:

Example 2: Calculate for a company with a current share price of $25, 20,000 shares outstanding, and $600,000 capital invested:

Q: What does a positive MVA indicate?

A: A positive MVA shows that the company is creating value for its shareholders.

Q: Can MVA be negative?

A: Yes, a negative MVA indicates the company is destroying shareholder value.

Q: How is current market value determined?

A: It is calculated as the current share price multiplied by the number of outstanding shares.