Home

Home

Back

Back

Definition: The MPS Calculator determines the marginal propensity to save (MPS), which measures the proportion of additional disposable income that households save.

Purpose: Helps economists and policymakers analyze savings behavior and its impact on economic models.

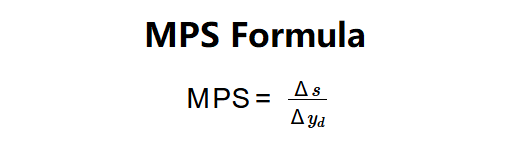

The calculator computes the MPS using the following formula and steps:

Formula:

Steps:

Calculating the MPS is crucial for:

Example: Increase in disposable income = $1,000, Increase in consumer savings = $300:

This indicates that 30% of the additional income is saved.

Q: What is the marginal propensity to save?

A: MPS is the proportion of additional disposable income that households save rather than spend.

Q: How is MPS related to MPC?

A: MPS and MPC sum to 1, as all additional income is either spent or saved.

Q: What does an MPS of 0.3 mean?

A: It means 30% of an income increase is saved, with the remaining 70% consumed.