1. What is the MIRR Calculator?

Definition: The MIRR Calculator computes the Modified Internal Rate of Return (MIRR), a financial metric that adjusts the traditional IRR by assuming positive cash flows are reinvested at a reinvestment rate and negative cash flows are financed at a financing rate.

Purpose: It provides a more accurate measure of an investment's profitability by addressing the reinvestment rate assumption, aiding in project evaluation and comparison.

2. How Does the Calculator Work?

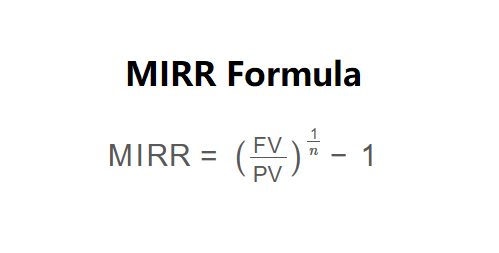

The calculator uses the following formula:

\( \text{MIRR} = \left( \frac{\text{FV}}{\text{PV}} \right)^{\frac{1}{n}} - 1 \)

Where:

- \( \text{FV} \): Future Value of positive cash flows, compounded at the reinvestment rate;

- \( \text{PV} \): Present Value of negative cash flows, discounted at the financing rate;

- \( n \): Number of periods (years).

Steps:

- Enter the initial investment (as a negative value).

- Enter the annual cash flows for up to 30 years (new fields appear as previous ones are filled).

- Enter the financing rate as a percentage (rate for discounting negative cash flows).

- Enter the reinvestment rate as a percentage (rate for compounding positive cash flows).

- Calculate the future value of positive cash flows, compounded to the last period.

- Calculate the present value of negative cash flows, discounted to the initial period.

- Compute MIRR using the formula above.

- Display the result as a percentage, formatted in scientific notation if the absolute value is less than 0.001, otherwise with 4 decimal places.

3. Importance of MIRR Calculation

Calculating MIRR is essential for:

- Accurate Profitability: Adjusts for realistic reinvestment rates, unlike IRR.

- Project Comparison: Enables better comparison of projects with different cash flow patterns.

- Investment Decisions: Helps in deciding whether to undertake or reject an investment.

4. Using the Calculator

Example: Calculate MIRR for an initial investment of -$10,000 with cash flows: $6,000 (Year 1), -$4,000 (Year 2), $8,000 (Year 3), $3,000 (Year 4), $7,000 (Year 5), financing rate of 10%, and reinvestment rate of 12%:

- Initial Investment: -$10,000;

- Year 1: $6,000;

- Year 2: -$4,000;

- Year 3: $8,000;

- Year 4: $3,000;

- Year 5: $7,000;

- Financing Rate: 10%;

- Reinvestment Rate: 12%;

- FV of Positive Cash Flows:

- \( 6,000 \times (1 + 0.12)^4 + 8,000 \times (1 + 0.12)^2 + 3,000 \times (1 + 0.12) + 7,000 = 29,836 \);

- PV of Negative Cash Flows: \( 10,000 - (-4,000) / (1 + 0.10)^2 = 13,306 \);

- MIRR: \( (29,836 / 13,306)^{1/5} - 1 = 17.53\% \).

5. Frequently Asked Questions (FAQ)

Q: What is the difference between MIRR and IRR?

A: MIRR assumes reinvestment at a specified rate and financing at another, while IRR assumes all cash flows are reinvested at the IRR itself, often overestimating returns.

Q: Why use MIRR?

A: MIRR provides a more realistic return metric by accounting for actual reinvestment and financing rates.

Q: Can MIRR be negative?

A: Yes, if the future value of positive cash flows is less than the present value of negative cash flows, indicating a loss.

Home

Home

Back

Back