Home

Home

Back

Back

Definition: The Loss Ratio Calculator computes the insurance loss ratio, which measures the ratio of claims and loss adjustment expenses to premiums earned, expressed as a percentage.

Purpose: Helps insurance companies and analysts assess financial performance, profitability, and claims management efficiency.

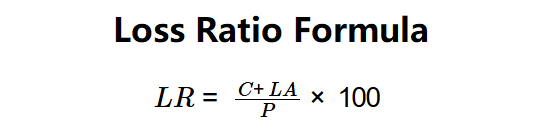

The calculator computes the loss ratio using the following formula:

Formula:

Steps:

Calculating the loss ratio is crucial for:

Example: Total premiums earned = $10,000,000, Insurance claims paid = $3,500,000, Loss adjustment expenses = $1,800,000:

This shows the insurer's financial performance.

Q: What are loss adjustment expenses?

A: Loss adjustment expenses are costs incurred to investigate, process, and validate insurance claims, such as legal or administrative fees.

Q: What is a good loss ratio?

A: A loss ratio below 60% is considered low (healthy), 60–80% is moderate, and above 80% is high, indicating potential financial strain.

Q: Why is the loss ratio expressed as a percentage?

A: Multiplying by 100 converts the ratio to a percentage, making it easier to interpret and compare across insurers.