Loan Interest Calculator

1. What is the Loan Interest Calculator?

Definition: The Loan Interest Calculator estimates the periodic payment, total payment, and interest to be paid for a loan, based on loan balance, loan term, annual interest rate, payment frequency, and compounding frequency.

Purpose: This tool helps borrowers understand the cost of borrowing, including interest and payment obligations, aiding in budgeting and loan comparison decisions.

2. How Does the Calculator Work?

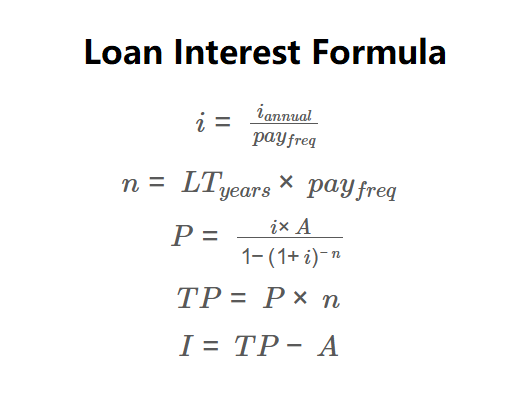

The calculator uses the following formulas:

\( i = \frac{i_{annual}}{pay_{freq}} \)

\( n = LT_{years} \times pay_{freq} \)

\( P = \frac{i \times A}{1 - (1 + i)^{-n}} \)

\( TP = P \times n \)

\( I = TP - A \)

Where:

- \( i \): Periodic interest rate (decimal);

- \( i_{annual} \): Annual interest rate (decimal);

- \( pay_{freq} \): Payment frequency (payments per year);

- \( n \): Number of payments;

- \( LT_{years} \): Loan term (years);

- \( A \): Loan balance ($);

- \( P \): Periodic payment ($);

- \( TP \): Total payment ($);

- \( I \): Interest to be paid ($).

Steps:

- Enter loan balance, loan term (years), annual interest rate, payment frequency, and compounding frequency.

- Verify payment and compounding frequencies match (as per example).

- Calculate periodic interest rate: \( i = \frac{i_{annual}}{pay_{freq}} \).

- Calculate number of payments: \( n = LT_{years} \times pay_{freq} \).

- Calculate periodic payment using the amortization formula.

- Calculate total payment: \( TP = P \times n \).

- Calculate interest paid: \( I = TP - A \).

- Display results in currency format.

Note: The calculator assumes payment and compounding frequencies are the same, as per the provided example. Different frequencies require an equivalent rate adjustment, which is not covered here.

3. Importance of Loan Interest Calculation

Calculating loan interest is essential for:

- Budget Planning: Determines periodic payments and total costs, ensuring affordability within financial plans.

- Cost Management: Estimates interest costs, helping compare loan offers and assess long-term financial impact.

- Financial Decision-Making: Assists in choosing between loan terms or deciding whether to pay off a loan early to reduce interest.

4. Using the Calculator

Example: Calculate the interest for a $10,000 loan with a 6% annual interest rate, 10-year term, and monthly payments:

- Loan Balance (\( A \)): $10,000;

- Loan Term (\( LT_{years} \)): 10 years;

- Interest Rate (\( i_{annual} \)): 6% (\( i = 0.06 / 12 = 0.005 \));

- Payment Frequency (\( pay_{freq} \)): 12;

- Number of Payments (\( n \)): \( 10 \times 12 = 120 \);

- Periodic Payment (\( P \)): \( \frac{0.005 \times 10000}{1 - (1.005)^{-120}} \approx 111.02 \);

- Total Payment (\( TP \)): \( 111.02 \times 120 \approx 13322.46 \);

- Interest Paid (\( I \)): \( 13322.46 - 10000 = 3322.46 \);

- Result: Periodic Payment: $111.02; Total Payment: $13,322.46; Interest to be Paid: $3,322.46.

5. Frequently Asked Questions (FAQ)

Q: What is loan interest?

A: Loan interest is the cost of borrowing, calculated as the difference between the total payments and the initial loan balance.

Q: How does payment frequency affect interest?

A: More frequent payments (e.g., monthly vs. annually) reduce interest costs by lowering the principal faster, assuming the same compounding frequency.

Q: How can I reduce interest paid?

A: Pay off the loan early, make additional principal payments, or choose a loan with a lower interest rate or shorter term.