Home

Home

Back

Back

Definition: The Loan Balance Calculator estimates the remaining balance of a loan after a specified period, based on the initial loan amount, annual interest rate, loan term, and time passed.

Purpose: This tool helps borrowers understand how much of their loan remains unpaid at a given point, aiding in financial planning, refinancing decisions, or assessing payoff strategies.

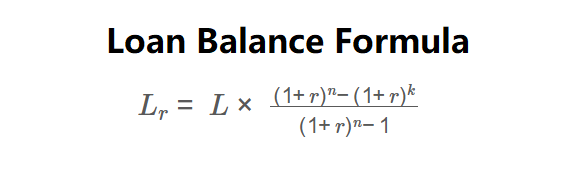

The calculator uses the following formula:

\( L_r = L \times \frac{(1 + r)^n - (1 + r)^k}{(1 + r)^n - 1} \)

Where:

Steps:

Calculating the remaining loan balance is essential for:

Example: Calculate the remaining balance for a $10,000 loan with a 6% annual interest rate, 60-month term, after 24 months:

Q: What is a remaining loan balance?

A: The remaining loan balance is the amount still owed on a loan after a certain number of payments, accounting for interest and principal paid.

Q: How does the period passed affect the balance?

A: A longer period passed means more payments have been made, reducing the remaining balance, assuming regular payments.

Q: Can I use this for early payoff planning?

A: Yes, knowing the remaining balance helps determine how much is needed to pay off the loan early or assess refinancing options.