Home

Home

Back

Back

Definition: The Liquid Net Worth Calculator computes an individual's liquid net worth by subtracting their total liabilities from their total liquid assets. Liquid net worth represents the amount of money a person can access quickly after paying off all debts.

Purpose: It helps individuals assess their financial health by focusing on assets that can be easily converted to cash (e.g., cash, stocks, bonds) and subtracting liabilities (e.g., loans, credit card debt). This metric is useful for financial planning, loan applications, and investment decisions.

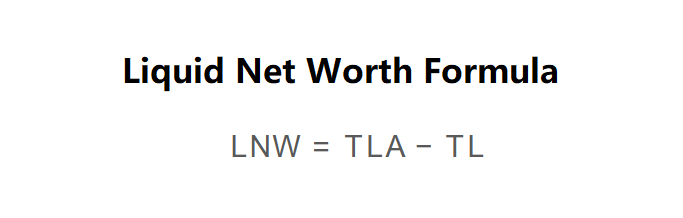

The calculator uses the following formula, as shown in the image above:

\( \text{LNW} = \text{TLA} - \text{TL} \)

Where:

Steps:

Calculating liquid net worth is essential for:

Example 1: Calculate the liquid net worth for an individual with total liquid assets of $50,000 and total liabilities of $20,000:

Example 2: Calculate the liquid net worth for an individual with total liquid assets of $100,000 and total liabilities of $120,000:

Q: What qualifies as a liquid asset?

A: Liquid assets are those that can be quickly converted to cash without significant loss in value, such as cash, savings accounts, stocks, bonds, and mutual funds. Illiquid assets like real estate or collectibles are typically excluded.

Q: Can liquid net worth be negative?

A: Yes, if total liabilities exceed total liquid assets, the liquid net worth will be negative, indicating that the individual owes more than they can quickly access in cash.

Q: How can someone improve their liquid net worth?

A: To improve liquid net worth, one can increase liquid assets by saving more or investing in easily sellable securities, and reduce liabilities by paying off debts like credit card balances or loans.