Home

Home

Back

Back

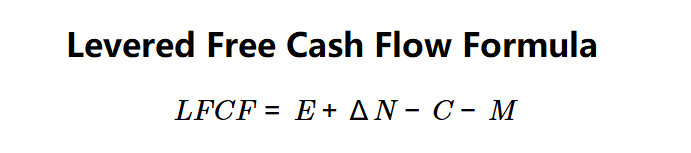

Definition: This calculator computes the levered free cash flow (\( LFCF \)), which represents the cash available to equity holders after accounting for operating cash flow, working capital changes, capital expenditures, and mandatory debt payments.

Purpose: Helps investors and businesses assess the cash flow available to shareholders after debt obligations, aiding in valuation and financial planning.

The calculator follows a single-step process to compute LFCF:

Formula:

Steps:

Note: Mandatory debt payment is often approximated using total debt/borrowing payments reported in the cash flow statement, as companies may not specify obligatory portions.

Calculating LFCF is crucial for:

Example 1 (Nvidia 2019): (Assuming \( \Delta N \), \( C \), and \( M \) are derived; using approximate values based on context) \( E = \$4,066,000,000 \), \( \Delta N = \$500,000,000 \), \( C = \$1,000,000,000 \), \( M = \$300,000,000 \):

An LFCF of $3,266,000,000 indicates significant cash available to equity holders after obligations.

Example 2: \( E = \$1,500,000,000 \), \( \Delta N = \$200,000,000 \), \( C = \$400,000,000 \), \( M = \$100,000,000 \):

An LFCF of $1,200,000,000 reflects a healthy cash flow for equity.

Example 3: \( E = \$800,000,000 \), \( \Delta N = \$-50,000,000 \), \( C = \$300,000,000 \), \( M = \$600,000,000 \):

A negative LFCF of -$150,000,000 indicates insufficient cash after debt payments.

Q: What is levered free cash flow?

A: Levered free cash flow (\( LFCF \)) is the cash available to equity holders after accounting for operating cash flow, working capital changes, capital expenditures, and debt obligations.

Q: Why is mandatory debt payment controversial?

A: Companies may not clearly distinguish mandatory versus discretionary debt payments, so it’s often estimated from total debt repayments in the cash flow statement.

Q: Can LFCF be negative?

A: Yes, if outflows (e.g., CapEx, debt payments) exceed inflows (e.g., EBITDA, ΔNWC), \( LFCF \) can be negative.