1. What is the Lease Calculator?

Definition: The Lease Calculator estimates the down payment, residual value, monthly payment, total payments, total interest, and total cost to own for a leasing contract, based on product value, lease amount, residual value, interest rate, and lease term.

Purpose: This tool helps users evaluate the financial implications of leasing an asset (e.g., a car or equipment), aiding in decisions about leasing versus buying by comparing total costs and monthly obligations.

2. How Does the Calculator Work?

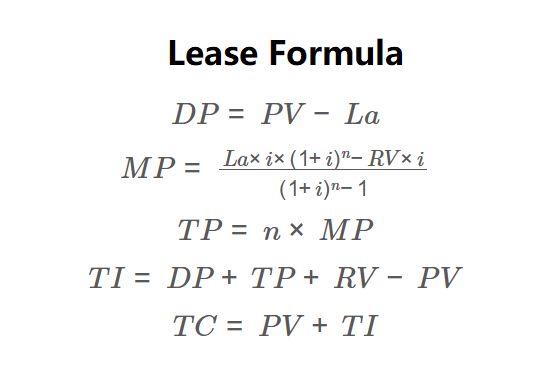

The calculator uses the following formulas:

\( DP = PV - La \)

\( MP = \frac{La \times i \times (1 + i)^n - RV \times i}{(1 + i)^n - 1} \)

\( TP = n \times MP \)

\( TI = DP + TP + RV - PV \)

\( TC = PV + TI \)

Where:

- \( DP \): Down payment ($);

- \( PV \): Product value ($);

- \( La \): Lease amount ($);

- \( RV \): Residual value ($);

- \( i \): Monthly interest rate (decimal, annual rate / 12);

- \( n \): Lease term (months);

- \( MP \): Monthly payment ($);

- \( TP \): Total payments ($);

- \( TI \): Total interest ($);

- \( TC \): Total cost to own ($).

Steps:

- Enter product value, lease amount, residual value, annual interest rate, and lease term (months).

- Calculate down payment: \( DP = PV - La \).

- Calculate monthly interest rate: \( i = \frac{\text{annual rate}}{12} \).

- Calculate monthly payment using the lease formula.

- Calculate total payments: \( TP = n \times MP \).

- Calculate total interest: \( TI = DP + TP + RV - PV \).

- Calculate total cost to own: \( TC = PV + TI \).

- Display results in currency format.

3. Importance of Lease Calculation

Calculating lease payments is essential for:

- Financial Planning: Determines monthly and total costs, helping assess affordability compared to buying.

- Cost Comparison: Evaluates total interest and cost to own, aiding decisions between leasing and purchasing via loans.

- Budget Management: Ensures lease payments fit within monthly budgets, considering lease amount and residual value impacts.

4. Using the Calculator

Example: Calculate the lease payments for an asset worth $30,000 with a $25,000 lease amount, $14,000 residual value, 4% interest rate, and 48-month lease term:

- Product Value (\( PV \)): $30,000; Lease Amount (\( La \)): $25,000;

- Down Payment (\( DP \)): \( 30000 - 25000 = 5000 \);

- Residual Value (\( RV \)): $14,000;

- Interest Rate: 4% (\( i = 0.04 / 12 \approx 0.003333 \)); Lease Term (\( n \)): 48;

- Monthly Payment (\( MP \)): \( \frac{25000 \times 0.003333 \times (1.003333)^{48} - 14000 \times 0.003333}{(1.003333)^{48} - 1} \approx 295.04 \);

- Total Payments (\( TP \)): \( 48 \times 295.04 \approx 14161.74 \);

- Total Interest (\( TI \)): \( 5000 + 14161.74 + 14000 - 30000 = 3161.74 \);

- Total Cost to Own (\( TC \)): \( 30000 + 3161.74 = 33161.74 \);

- Result: Down Payment: $5,000.00; Residual Value: $14,000.00; Monthly Payment: $295.04; Total Payments: $14,161.74; Total Interest: $3,161.74; Total Cost to Own: $33,161.74.

5. Frequently Asked Questions (FAQ)

Q: What is a lease?

A: A lease is a contract allowing use of an asset (e.g., a car or equipment) for a fixed period in exchange for periodic payments, with an option to purchase at the residual value.

Q: How does residual value affect lease payments?

A: A higher residual value reduces monthly payments, as it lowers the amount financed over the lease term, but increases the cost to own if purchasing the asset.

Q: Should I lease or buy?

A: Compare the total cost to own from leasing with the cost of buying. Leasing may offer lower monthly payments but higher long-term costs due to interest and residual value.

Home

Home

Back

Back