1. What is the Land Loan Payment Calculator?

Definition: The Land Loan Payment Calculator estimates the periodic payment, total payment, total interest paid, down payment, periodic interest rate, and number of payments for a land loan, based on land value, down payment percentage, annual interest rate, loan term, and payment frequency.

Purpose: This tool helps users plan for land purchases by calculating the financial obligations of a land loan, aiding in budgeting and assessing affordability, especially given the higher risk and rates associated with land loans compared to traditional mortgages.

2. How Does the Calculator Work?

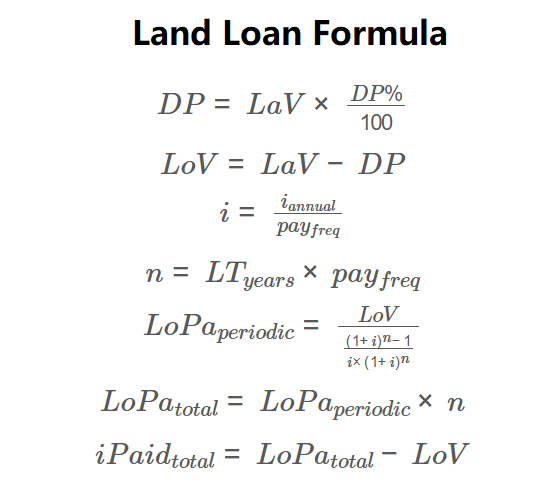

The calculator uses the following formulas:

\( DP = LaV \times \frac{DP\%}{100} \)

\( LoV = LaV - DP \)

\( i = \frac{i_{annual}}{pay_{freq}} \)

\( n = LT_{years} \times pay_{freq} \)

\( LoPa_{periodic} = \frac{LoV}{\frac{(1+i)^n - 1}{i \times (1+i)^n}} \)

\( LoPa_{total} = LoPa_{periodic} \times n \)

\( iPaid_{total} = LoPa_{total} - LoV \)

Where:

- \( DP \): Down payment ($);

- \( LaV \): Land value ($);

- \( DP\% \): Down payment percentage (%);

- \( LoV \): Loan value ($);

- \( i \): Periodic interest rate (decimal);

- \( i_{annual} \): Annual interest rate (decimal);

- \( pay_{freq} \): Payment frequency (payments per year);

- \( n \): Number of payments;

- \( LT_{years} \): Loan term (years);

- \( LoPa_{periodic} \): Periodic payment ($);

- \( LoPa_{total} \): Total payment ($);

- \( iPaid_{total} \): Total interest paid ($).

Steps:

- Enter land value, down payment percentage, annual interest rate, loan term, and payment frequency.

- Calculate down payment: \( DP = LaV \times \frac{DP\%}{100} \).

- Calculate loan value: \( LoV = LaV - DP \).

- Calculate periodic interest rate: \( i = \frac{i_{annual}}{pay_{freq}} \).

- Calculate number of payments: \( n = LT_{years} \times pay_{freq} \).

- Calculate periodic payment using the amortization formula.

- Calculate total payment: \( LoPa_{total} = LoPa_{periodic} \times n \).

- Calculate total interest: \( iPaid_{total} = LoPa_{total} - LoV \).

- Display results in currency, percentage, and integer formats.

3. Importance of Land Loan Payment Calculation

Calculating land loan payments is essential for:

- Budget Planning: Determines affordable periodic payments and total costs, critical for high-risk land loans requiring larger down payments (20-50%).

- Cost Management: Estimates total interest paid, helping compare loan terms and negotiate rates, especially since land loans often have higher rates due to lack of collateral.

- Financial Strategy: Assesses the impact of down payment percentage and payment frequency on loan affordability and total cost.

4. Using the Calculator

Example: Calculate the payments for a $100,000 land purchase with a 20% down payment, 5% annual interest rate, 10-year loan term, and monthly payments:

- Land Value (\( LaV \)): $100,000; Down Payment Percentage (\( DP\% \)): 20%;

- Down Payment (\( DP \)): \( 100000 \times \frac{20}{100} = 20000 \);

- Loan Value (\( LoV \)): \( 100000 - 20000 = 80000 \);

- Annual Interest Rate (\( i_{annual} \)): \( 5\% = 0.05 \); Payment Frequency (\( pay_{freq} \)): 12;

- Periodic Rate (\( i \)): \( 0.05 / 12 \approx 0.004167 \);

- Number of Payments (\( n \)): \( 10 \times 12 = 120 \);

- Periodic Payment (\( LoPa_{periodic} \)): \( 80000 \times \frac{0.004167}{1 - (1.004167)^{-120}} \approx 1058.19 \);

- Total Payment (\( LoPa_{total} \)): \( 1058.19 \times 120 \approx 126982.80 \);

- Total Interest (\( iPaid_{total} \)): \( 126982.80 - 80000 = 46982.80 \);

- Result: Down Payment: $20,000.00; Periodic Interest Rate: 0.42%; Number of Payments: 120; Periodic Payment: $1,058.19; Total Payment: $126,982.80; Total Interest Paid: $46,982.80.

5. Frequently Asked Questions (FAQ)

Q: What is a land loan?

A: A land loan is a loan used to purchase raw or vacant land, often requiring larger down payments and higher interest rates due to higher risk and lack of collateral compared to home mortgages.

Q: How does payment frequency affect the loan?

A: More frequent payments (e.g., monthly vs. annually) can reduce total interest paid by lowering the principal faster, though the effect is minimal in this calculator.

Q: Why is the down payment percentage important?

A: A higher down payment percentage reduces the loan value, lowering periodic payments and total interest, and may improve loan approval chances due to reduced lender risk.

Land Loan Payment Calculator© - All Rights Reserved 2025

Home

Home

Back

Back