1. What is the Loss Given Default (LGD) Calculator?

Definition: This calculator computes the loss given default (\( LGD \)), the amount of money an investor is likely to lose if a borrower defaults, based on recovery rate, loss severity, and expected exposure.

Purpose: Helps investors and risk managers assess potential losses in credit investments, aiding in risk assessment and loan pricing.

2. How Does the Calculator Work?

The calculator follows a three-step process to compute the LGD:

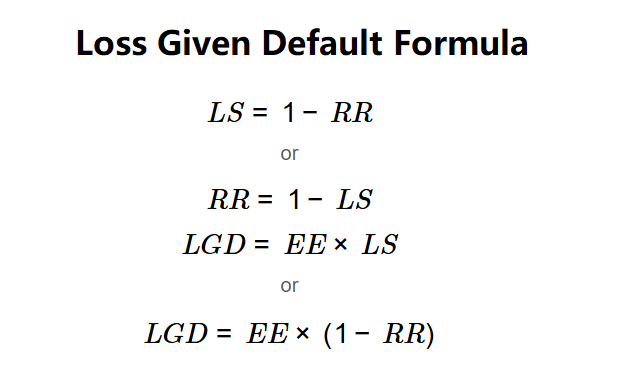

Formulas:

\( LS = 1 - RR \)

or

\( RR = 1 - LS \)

\( LGD = EE \times LS \)

or

\( LGD = EE \times (1 - RR) \)

Where:

- \( LGD \): Loss Given Default (dollars)

- \( RR \): Recovery Rate (decimal)

- \( LS \): Loss Severity (decimal)

- \( EE \): Expected Exposure (dollars)

Steps:

- Step 1: Determine recovery rate or loss severity. Input one value (e.g., \( RR \) or \( LS \)); the other is calculated as \( LS = 1 - RR \) or \( RR = 1 - LS \).

- Step 2: Determine expected exposure. Input the amount of investment (\( EE \)).

- Step 3: Calculate LGD. Compute \( LGD = EE \times LS \) or \( LGD = EE \times (1 - RR) \).

3. Importance of Loss Given Default Calculation

Calculating LGD is crucial for:

- Risk Assessment: Quantifies potential loss in case of default, critical for credit risk modeling.

- Loan Pricing: Helps lenders set interest rates to compensate for expected losses.

- Portfolio Management: Assists in balancing risk across credit investments.

4. Using the Calculator

Example (Company Alpha): \( RR = 80\% \), \( EE = \$1,000,000 \):

- Step 1: \( RR = 0.80 \), \( LS = 1 - 0.80 = 0.20 \) (20%).

- Step 2: \( EE = \$1,000,000 \).

- Step 3: \( LGD = 1,000,000 \times 0.20 = \$200,000 \).

- Results: \( RR = 80.00\% \), \( LS = 20.00\% \), \( LGD = \$200,000.00 \).

An LGD of $200,000 indicates a 20% loss on a $1,000,000 exposure if Company Alpha defaults.

Example 2: \( LS = 40\% \), \( EE = \$500,000 \):

- Step 1: \( LS = 0.40 \), \( RR = 1 - 0.40 = 0.60 \) (60%).

- Step 2: \( EE = \$500,000 \).

- Step 3: \( LGD = 500,000 \times 0.40 = \$200,000 \).

- Results: \( RR = 60.00\% \), \( LS = 40.00\% \), \( LGD = \$200,000.00 \).

An LGD of $200,000 reflects a 40% loss on a $500,000 exposure.

Example 3: \( RR = 90\% \), \( EE = \$2,000,000 \):

- Step 1: \( RR = 0.90 \), \( LS = 1 - 0.90 = 0.10 \) (10%).

- Step 2: \( EE = \$2,000,000 \).

- Step 3: \( LGD = 2,000,000 \times 0.10 = \$200,000 \).

- Results: \( RR = 90.00\% \), \( LS = 10.00\% \), \( LGD = \$200,000.00 \).

An LGD of $200,000 indicates a 10% loss on a $2,000,000 exposure, suggesting high recovery potential.

5. Frequently Asked Questions (FAQ)

Q: What does LGD represent?

A: LGD is the portion of an exposure lost if a borrower defaults, after accounting for recovery.

Q: Why input only one of recovery rate or loss severity?

A: They are inversely related (\( RR + LS = 1 \)), so providing one calculates the other, ensuring consistency.

Q: Can LGD exceed expected exposure?

A: No, LGD is capped at \( EE \) since \( LS \leq 1 \).

Loss Given Default Calculator© - All Rights Reserved 2025

Home

Home

Back

Back