Home

Home

Back

Back

Definition: The LCR Calculator measures a bank's liquidity coverage ratio, ensuring it has sufficient high-quality liquid assets to cover cash outflows during a 30-day stress scenario.

Purpose: Helps banks and regulators assess financial stability and compliance with Basel III requirements.

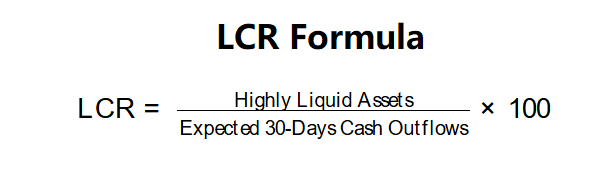

The calculator computes the LCR using the following formula and steps:

Formula:

Steps:

Calculating the LCR is crucial for:

Example (Bank Alpha): Cash and cash equivalents = $1,000,000, Marketable securities = $750,000, Expected 30-days cash outflows = $1,500,000:

This indicates Bank Alpha exceeds the minimum LCR requirement.

Q: What is the LCR?

A: The LCR is a ratio that measures a bank's ability to cover short-term cash outflows with high-quality liquid assets during a 30-day stress period.

Q: What are highly liquid assets?

A: These are assets like cash and marketable securities that can be quickly converted to cash with minimal loss of value.

Q: What does an LCR above 100% mean?

A: It indicates the bank has more than enough liquid assets to meet its obligations, suggesting financial stability.