1. What is the Jensen's Alpha Calculator?

Definition: The Jensen's Alpha Calculator computes Jensen's Alpha, a risk-adjusted performance metric that measures a portfolio's excess return compared to the expected return predicted by the Capital Asset Pricing Model (CAPM).

Purpose: It helps investors determine whether a portfolio outperforms the market on a risk-adjusted basis, providing insight into a portfolio manager's skill.

2. How Does the Calculator Work?

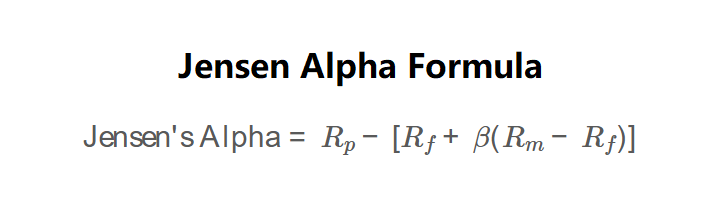

The calculator uses the following formula:

\( \text{Jensen's Alpha} = R_p - [R_f + \beta (R_m - R_f)] \)

Where:

- \( R_p \): Portfolio Return (%), calculated as \( \frac{\text{Ending Value} - \text{Beginning Value}}{\text{Beginning Value}} \times 100 \);

- \( R_f \): Risk-Free Rate (%);

- \( \beta \): Portfolio Beta (systematic risk relative to the market);

- \( R_m \): Market Return (%).

Steps:

- Enter the beginning portfolio value in dollars.

- Enter the ending portfolio value in dollars.

- Enter the risk-free rate as a percentage (e.g., U.S. Treasury bill rate).

- Enter the portfolio beta (a measure of market risk).

- Enter the market return as a percentage (e.g., S&P 500 average return).

- Calculate the portfolio return using the formula above.

- Calculate the expected return using CAPM: \( R_f + \beta (R_m - R_f) \).

- Subtract the expected return from the portfolio return to get Jensen's Alpha.

- Display the portfolio return and Jensen's Alpha as percentages, formatted in scientific notation if the absolute value is less than 0.001, otherwise with 4 decimal places.

3. Importance of Jensen's Alpha Calculation

Calculating Jensen's Alpha is essential for:

- Risk-Adjusted Performance: Assesses whether excess returns are due to skill or risk.

- Manager Evaluation: Helps identify portfolio managers who consistently outperform the market.

- Investment Decisions: Guides investors in selecting funds with positive alpha.

4. Using the Calculator

Example 1: Calculate Jensen's Alpha for a portfolio with a beginning value of $10,000, ending value of $12,000, 2% risk-free rate, beta of 1.2, and 11% market return:

- Beginning Value: $10,000;

- Ending Value: $12,000;

- Portfolio Return: \( \frac{12,000 - 10,000}{10,000} \times 100 = 20\% \);

- Risk-Free Rate: 2%;

- Beta: 1.2;

- Market Return: 11%;

- Expected Return: \( 2 + 1.2 \times (11 - 2) = 12.6\% \);

- Jensen's Alpha: \( 20 - 12.6 = 7.4\% \).

Example 2: Calculate for a portfolio with a beginning value of $5,000, ending value of $5,250, 1% risk-free rate, beta of 0.8, and 10% market return:

- Beginning Value: $5,000;

- Ending Value: $5,250;

- Portfolio Return: \( \frac{5,250 - 5,000}{5,000} \times 100 = 5\% \);

- Risk-Free Rate: 1%;

- Beta: 0.8;

- Market Return: 10%;

- Expected Return: \( 1 + 0.8 \times (10 - 1) = 8.2\% \);

- Jensen's Alpha: \( 5 - 8.2 = -3.2\% \).

5. Frequently Asked Questions (FAQ)

Q: What does a positive Jensen's Alpha mean?

A: A positive value indicates the portfolio has outperformed the market on a risk-adjusted basis.

Q: Can Jensen's Alpha be negative?

A: Yes, a negative value means the portfolio underperformed the market, adjusted for risk.

Q: Why is beta important in this calculation?

A: Beta measures the portfolio's sensitivity to market movements, ensuring the return is adjusted for systematic risk.

Jensen's Alpha Calculator© - All Rights Reserved 2025

Home

Home

Back

Back