1. What is the Investment Fees Calculator?

Definition: The Investment Fees Calculator computes the impact of fees on an investment, including sales load, operating fees, turnover costs, and redemption fees, to determine the final fund value and effective return.

Purpose: It helps investors understand how fees reduce their returns, aiding in the evaluation of investment options and financial planning.

2. How Does the Calculator Work?

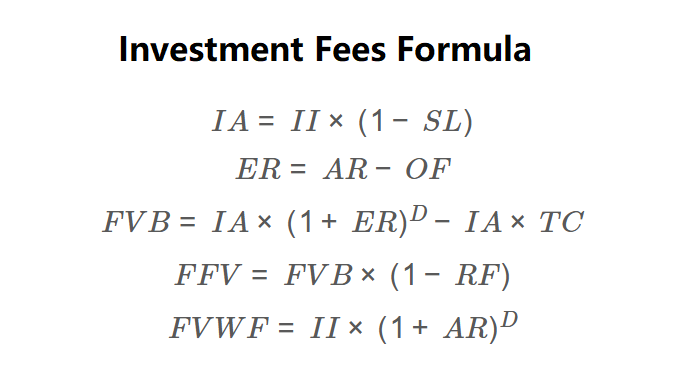

The calculator uses the following formulas:

\( IA = II \times (1 - SL) \)

\( ER = AR - OF \)

\( FVB = IA \times (1 + ER)^D - IA \times TC \)

\( FFV = FVB \times (1 - RF) \)

\( FVWF = II \times (1 + AR)^D \)

Where:

- \( IA \): Invested Amount ($);

- \( II \): Initial Investment Amount ($);

- \( SL \): Sales Load (%);

- \( ER \): Effective Return (%);

- \( AR \): Annual Return (%);

- \( OF \): Annual Operating Fees (%);

- \( FVB \): Fund Value Before Redemption ($);

- \( D \): Investment Duration (years);

- \( TC \): Turnover Cost (%);

- \( RF \): Redemption Fees (%);

- \( FFV \): Final Fund Value ($);

- \( FVWF \): Fund Value Without Fees ($).

Steps:

- Enter the initial investment amount in dollars.

- Enter the sales load as a percentage.

- Enter the annual return as a percentage.

- Enter the annual operating fees as a percentage.

- Enter the investment duration in years.

- Enter the turnover cost as a percentage.

- Enter the redemption fees as a percentage.

- Calculate the invested amount by subtracting the sales load.

- Calculate the effective return by subtracting operating fees from the annual return.

- Calculate the fund value before redemption using the effective return and turnover cost.

- Calculate the final fund value by applying the redemption fee.

- Calculate the fund value without fees for comparison.

- Compute total fees as the difference between fund value without fees and final fund value.

- Display all results, formatted in scientific notation if the absolute value is less than 0.001, otherwise with 4 decimal places.

3. Importance of Investment Fees Calculation

Calculating investment fees is essential for:

- Return Accuracy: Reveals the true return after fees, which can significantly reduce net gains over time.

- Cost Awareness: Helps investors compare funds by understanding the impact of various fees.

- Decision Making: Assists in selecting low-cost investment options to maximize long-term growth.

4. Using the Calculator

Example 1: Calculate for an initial investment of $10,000 with a 2% sales load, 10% annual return, 2% operating fees, 10 years duration, 3% turnover cost, and 2% redemption fee:

- \( II \): $10,000;

- \( SL \): 2%;

- \( AR \): 10%;

- \( OF \): 2%;

- \( D \): 10;

- \( TC \): 3%;

- \( RF \): 2%;

- \( IA \): \( 10,000 \times (1 - 0.02) = 9,800 \);

- \( ER \): \( 10 - 2 = 8\% \);

- \( FVB \): \( 9,800 \times (1 + 0.08)^{10} - 9,800 \times 0.03 = 20,863.46 \);

- \( FFV \): \( 20,863.46 \times (1 - 0.02) = 20,446.20 \);

- \( FVWF \): \( 10,000 \times (1 + 0.10)^{10} = 25,937.42 \);

- \( Total Fees \): \( 25,937.42 - 20,446.20 = 5,491.22 \).

5. Frequently Asked Questions (FAQ)

Q: What are investment fees?

A: Investment fees include sales load (initial charge), operating fees (annual management costs), turnover costs (transaction costs), and redemption fees (exit charges), all of which reduce the net return.

Q: How do fees impact my investment?

A: Fees compound over time, significantly lowering the final value, as shown by the difference between fund value without fees and final fund value.

Q: Can I minimize fees?

A: Yes, by choosing funds with lower sales loads, operating fees, and turnover costs, or avoiding early redemption to skip redemption fees.

Investment Fees Calculator© - All Rights Reserved 2025

Home

Home

Back

Back