Home

Home

Back

Back

Definition: The Investment Calculator computes the final balance of an investment over a period of time using the compound interest formula. It helps determine how much an initial investment will grow based on interest rate and compounding frequency.

Purpose: It is used by investors to plan and forecast the growth of their investments, such as stocks, bonds, or savings accounts, over specified periods.

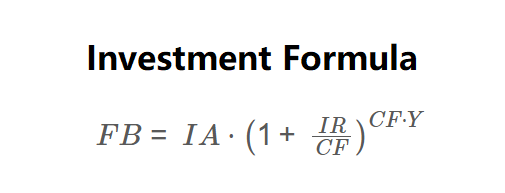

The calculator uses the following formula:

\( FB = IA \cdot \left(1 + \frac{IR}{CF}\right)^{CF \cdot Y} \)

Where:

Steps:

Calculating the final balance is essential for:

Example 1: Calculate the final balance for a $10,000 investment with a 5% interest rate over 3 years, compounded annually:

Example 2: Calculate the final balance for a $5,000 investment with a 3% interest rate over 2 years, compounded monthly:

Q: What is compound interest?

A: Compound interest is the interest calculated on the initial principal and also on the accumulated interest from previous periods, leading to exponential growth.

Q: How does compounding frequency affect the result?

A: Higher compounding frequency (e.g., monthly vs. annually) increases the final balance by applying interest more often.

Q: Can this calculator account for inflation?

A: This basic version does not adjust for inflation. For more complex calculations, consider additional tools or adjustments to the interest rate.