1. What is the Inventory Turnover and Related Metrics Calculator?

Definition: This calculator computes the average inventory (\( AvgInv \)), inventory turnover (\( InvTurnover \)), and inventory days (\( InvDays \)), which measure how efficiently a company manages its inventory over a user-defined period.

Purpose: Helps businesses assess inventory efficiency, optimize stock levels, and improve cash flow by analyzing turnover rates and days on hand based on a customizable period.

2. How Does the Calculator Work?

The calculator follows a three-step process to compute inventory metrics using a user-specified period:

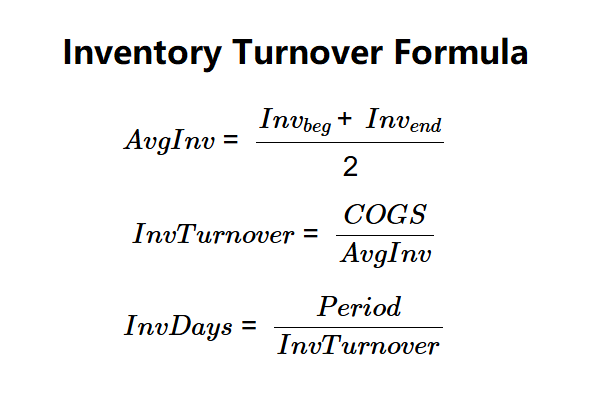

Formulas:

$$ AvgInv = \frac{Inv_{beg} + Inv_{end}}{2} $$

$$ InvTurnover = \frac{COGS}{AvgInv} $$

$$ InvDays = \frac{Period}{InvTurnover} $$

Where:

- \( AvgInv \): Average Inventory (dollars)

- \( Inv_{beg} \): Beginning Inventory (dollars)

- \( Inv_{end} \): Ending Inventory (dollars)

- \( COGS \): Cost of Goods Sold (dollars)

- \( InvTurnover \): Inventory Turnover (times)

- \( InvDays \): Inventory Days (days)

- \( Period \): Length of the period (days)

Steps:

- Step 1: Determine \( Inv_{beg} \) and \( Inv_{end} \). Input the inventory values at the beginning and end of the period.

- Step 2: Calculate \( AvgInv \). Average the beginning and ending inventory.

- Step 3: Determine \( COGS \). Input the cost of goods sold for the period.

- Step 4: Determine \( Period \). Input the length of the period in days.

- Step 5: Calculate \( InvTurnover \). Divide \( COGS \) by \( AvgInv \).

- Step 6: Calculate \( InvDays \). Divide \( Period \) by \( InvTurnover \).

3. Importance of Inventory Turnover Calculation

Calculating inventory turnover and days is crucial for:

- Inventory Management: A higher \( InvTurnover \) indicates efficient stock use, while \( InvDays \) shows how long inventory is held.

- Financial Efficiency: Helps optimize inventory to reduce holding costs and improve liquidity.

- Performance Benchmarking: Allows comparison with industry standards based on the chosen period.

4. Using the Calculator

Example 1:

\( COGS = \$50,000 \), \( Inv_{beg} = \$10,000 \), \( Inv_{end} = \$12,000 \), \( Period = 365 \) days:

- Step 1: \( Inv_{beg} = \$10,000 \), \( Inv_{end} = \$12,000 \).

- Step 2: \( AvgInv = \frac{10,000 + 12,000}{2} = \$11,000 \).

- Step 3: \( COGS = \$50,000 \).

- Step 4: \( Period = 365 \) days.

- Step 5: \( InvTurnover = \frac{50,000}{11,000} \approx 4.55 \).

- Step 6: \( InvDays = \frac{365}{4.55} \approx 80.22 \) days.

- Results: \( AvgInv = \$11,000 \), \( InvTurnover = 4.55 \), \( InvDays = 80.22 \) days.

An inventory turnover of 4.55 and 80.22 days suggest moderate efficiency over a year.

Example 2:

\( COGS = \$60,000 \), \( Inv_{beg} = \$20,000 \), \( Inv_{end} = \$15,000 \), \( Period = 90 \) days:

- Step 1: \( Inv_{beg} = \$20,000 \), \( Inv_{end} = \$15,000 \).

- Step 2: \( AvgInv = \frac{20,000 + 15,000}{2} = \$17,500 \).

- Step 3: \( COGS = \$60,000 \).

- Step 4: \( Period = 90 \) days.

- Step 5: \( InvTurnover = \frac{60,000}{17,500} \approx 3.43 \).

- Step 6: \( InvDays = \frac{90}{3.43} \approx 26.24 \) days.

- Results: \( AvgInv = \$17,500 \), \( InvTurnover = 3.43 \), \( InvDays = 26.24 \) days.

An inventory turnover of 3.43 and 26.24 days indicate efficient quarterly turnover.

Example 3:

\( COGS = \$30,000 \), \( Inv_{beg} = \$5,000 \), \( Inv_{end} = \$7,000 \), \( Period = 180 \) days:

- Step 1: \( Inv_{beg} = \$5,000 \), \( Inv_{end} = \$7,000 \).

- Step 2: \( AvgInv = \frac{5,000 + 7,000}{2} = \$6,000 \).

- Step 3: \( COGS = \$30,000 \).

- Step 4: \( Period = 180 \) days.

- Step 5: \( InvTurnover = \frac{30,000}{6,000} = 5.00 \).

- Step 6: \( InvDays = \frac{180}{5.00} = 36.00 \) days.

- Results: \( AvgInv = \$6,000 \), \( InvTurnover = 5.00 \), \( InvDays = 36.00 \) days.

An inventory turnover of 5.00 and 36.00 days reflect efficient inventory management over six months.

5. Frequently Asked Questions (FAQ)

Q: What is inventory turnover?

A: Inventory turnover (\( InvTurnover \)) measures how many times a company's inventory is sold and replaced over a period.

Q: What does inventory days represent?

A: Inventory days (\( InvDays \)) indicate the average number of days it takes to sell the entire inventory, based on the specified period.

Q: Can inventory turnover be zero?

A: No, a zero or negative turnover would indicate an error, as it requires positive COGS and average inventory.

Inventory Turnover and Related Metrics Calculator© - All Rights Reserved 2026

Home

Home

Back

Back