1. What is Intrinsic Value Calculator?

Definition: This calculator computes the intrinsic value of a stock using Benjamin Graham's formulas, guiding value investing decisions.

Purpose: Helps investors identify undervalued stocks by comparing intrinsic value to market price.

2. How Does the Calculator Work?

The calculator supports two modes:

Initial Formula:

\( V = \text{EPS} \times (8.5 + 2g) \)

Where:

- \( V \): Intrinsic Value (dollars/share)

- \( \text{EPS} \): Earnings Per Share (dollars/share)

- \( g \): Expected Growth Rate (decimal)

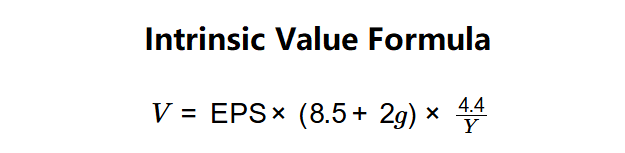

Revised Formula:

\( V = \text{EPS} \times (8.5 + 2g) \times \frac{4.4}{Y} \)

Where:

- \( Y \): Current AAA Bond Yield (decimal)

- \( 4.4 \): 1962 risk-free return rate (%)

Steps:

- Select calculation mode (Initial or Revised).

- Enter EPS and growth rate; for revised mode, add bond yield.

- Apply the formula and display with 2 decimal places.

3. Importance of Intrinsic Value

Calculating intrinsic value is crucial for:

- Valuation: Identifies stocks trading below their true worth.

- Investment Safety: Provides a margin of safety against market volatility.

- Long-Term Strategy: Aligns with Graham’s value investing principles.

4. Using the Calculator

Example 1 (Initial): EPS = $5.00, g = 0.10:

- EPS: $5.00

- Growth Rate: 0.10

- Intrinsic Value: \( 5.00 \times (8.5 + 2 \times 0.10) = 5.00 \times 8.7 = 43.50 \) dollars/share

- Result: \( 43.50 \) dollars/share

Example 2 (Revised): EPS = $2.50, g = 0.10, Y = 0.05:

- EPS: $2.50

- Growth Rate: 0.10

- Bond Yield: 0.05

- Intrinsic Value: \( 2.50 \times (8.5 + 2 \times 0.10) \times \frac{4.4}{0.05} = 2.50 \times 8.7 \times 88 = 1,909.40 \) dollars/share

- Result: \( 1,909.40 \) dollars/share

Example 3 (Revised, Adjusted): EPS = $5.00, g = 0.15, Y = 0.04:

- EPS: $5.00

- Growth Rate: 0.15

- Bond Yield: 0.04

- Intrinsic Value: \( 5.00 \times (8.5 + 2 \times 0.15) \times \frac{4.4}{0.04} = 5.00 \times 8.8 \times 110 = 4,840.00 \) dollars/share

- Result: \( 4,840.00 \) dollars/share

5. Frequently Asked Questions (FAQ)

Q: What is a good intrinsic value?

A: A stock is undervalued if its market price is below the intrinsic value; use a margin of safety.

Q: Why adjust for bond yield?

A: It reflects current interest rates, adjusting the formula for economic conditions since 1962.

Q: Where to find EPS and growth rate?

A: EPS from income statements, growth rate from analyst forecasts or historical data.

Intrinsic Value Calculator© - All Rights Reserved 2025

Home

Home

Back

Back