Home

Home

Back

Back

Definition: This calculator computes the interest-only mortgage payment (P) for a loan, where only interest is paid during the initial period, based on the loan amount and annual interest rate.

Purpose: Helps borrowers estimate monthly or yearly payments for interest-only mortgages, aiding in budgeting and comparing loan options.

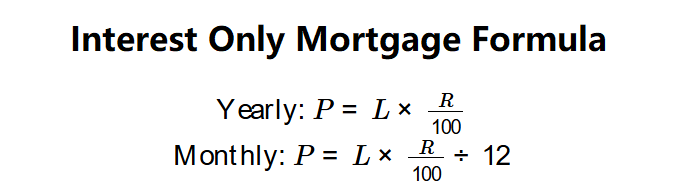

The calculator uses these formulas:

Formulas:

Steps:

Calculating interest-only payments is key for:

Example: For a loan with \( L = \$350,000 \), \( R = 4\% \):

This shows the borrower pays $1,166.67 monthly or $14,000 yearly in interest during the interest-only period.

Q: How do you calculate interest-only mortgage payments?

A: Interest-only payments are calculated in two steps: (1) Input the loan amount (\( L \)), annual interest rate (\( R \)), and payment frequency; (2) Calculate the payment using \( P = L \times \frac{R}{100} \) for yearly, or \( P = L \times \frac{R}{100} \div 12 \) for monthly. For example, a $350,000 loan at 4% yields \( P = \$14,000/year \) or \( \$1,166.67/month \).

Q: What happens after the interest-only period?

A: After the interest-only period, payments typically increase to include principal repayment, either as a fully amortizing loan or a balloon payment, depending on the loan terms.

Q: Are interest-only mortgages risky?

A: They can be, as you don’t reduce the principal during the interest-only period, leading to higher payments later. They suit borrowers with strong future income expectations or investment strategies.