Home

Home

Back

Back

Definition: The Information Ratio Calculator computes the Information Ratio, a performance metric that evaluates a portfolio manager's ability to generate excess returns over a benchmark, relative to the tracking error (volatility of the excess returns). It measures the consistency and skill of active portfolio management.

Purpose: It is used by investors and financial analysts to assess whether a portfolio's excess returns justify the additional risk taken compared to a benchmark, such as the S&P 500, helping to evaluate the effectiveness of investment strategies.

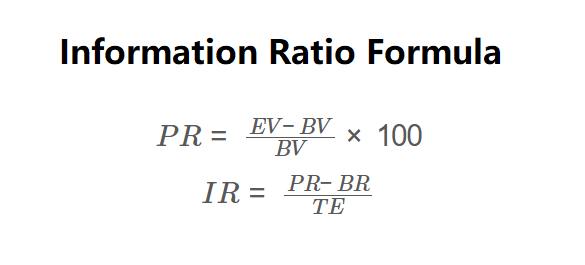

The calculator uses the following formulas:

\( PR = \frac{EV - BV}{BV} \times 100 \)

\( IR = \frac{PR - BR}{TE} \)

Where:

Steps:

Calculating the Information Ratio is essential for:

Example 1: Calculate the Information Ratio for a portfolio with a beginning value of $100,000, an ending value of $112,000, a benchmark return of 8%, and a tracking error of 5%:

Example 2: Calculate the Information Ratio for a portfolio with a beginning value of $50,000, an ending value of $57,500, a benchmark return of 10%, and a tracking error of 3%:

Q: What is the Information Ratio?

A: The Information Ratio measures a portfolio's excess return over a benchmark per unit of tracking error, indicating the consistency and skill of a portfolio manager.

Q: How does the Information Ratio differ from the Sharpe Ratio?

A: The Sharpe Ratio compares portfolio returns to a risk-free rate, using the standard deviation of portfolio returns, while the Information Ratio compares returns to a benchmark, using tracking error. The Information Ratio focuses on active management skill.

Q: What is a good Information Ratio?

A: A ratio above 0.5 is generally considered good, above 1.0 is excellent, and below 0 indicates underperformance relative to the benchmark. However, this varies by investment strategy and market conditions.