Home

Home

Back

Back

Definition: This calculator computes the interest coverage ratio (\( ICR \)), a measure of a company’s ability to cover its interest expenses with its earnings before interest and taxes.

Purpose: Helps investors, creditors, and analysts assess a company’s financial health and its capacity to meet interest obligations, indicating potential risk of default.

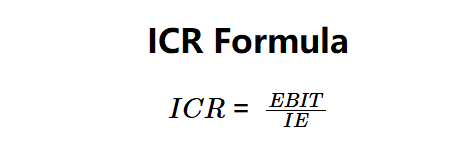

The calculator uses the following formula to compute the ICR:

Formula:

Steps:

Calculating the ICR is crucial for:

Example 1: \( EBIT = \$200,000 \), \( IE = \$50,000 \):

An ICR of 4.00 indicates the company can cover interest expenses four times, suggesting strong financial health.

Example 2: \( EBIT = \$100,000 \), \( IE = \$80,000 \):

An ICR of 1.25 is near the minimum acceptable level, indicating potential financial strain.

Example 3: \( EBIT = \$50,000 \), \( IE = \$100,000 \):

An ICR of 0.50 indicates the company cannot cover interest expenses, signaling high default risk.

Q: What is a good ICR?

A: An ICR above 2 or 3 is generally considered healthy, though it varies by industry; values below 1 indicate insufficient coverage.

Q: Can ICR be negative?

A: Yes, if EBIT is negative (e.g., operating losses), indicating severe financial distress.

Q: Why use EBIT instead of net income?

A: EBIT excludes interest and taxes, focusing on operating earnings to assess debt coverage ability.