Home

Home

Back

Back

Definition: This calculator estimates the maximum loan amount (A) you can afford based on your maximum monthly payment, loan term, and interest rate, with optional adjustments for down payment, debts, insurance, taxes, and closing costs to estimate the maximum home value (H).

Purpose: Helps prospective homebuyers determine their borrowing capacity and affordable home price, aiding in financial planning and home shopping.

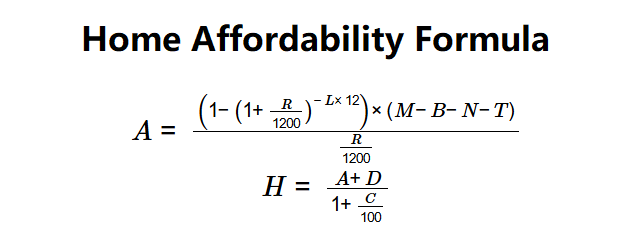

The calculator uses these formulas:

Formulas:

Steps:

Calculating the maximum loan is key for:

Example: For a buyer with \( M = \$2,000 \), \( L = 30 \), \( R = 5\% \), \( D = \$20,000 \), \( B = \$500 \), \( N = \$100 \), \( T = \$200 \), \( C = 3\% \):

With defaults (\( D = 0 \), \( B = 0 \), \( N = 0 \), \( T = 0 \), \( C = 0 \)), \( A \approx \$372,223.44 \), \( H = \$372,223.44 \). This shows the buyer can borrow up to $223,334.06, affording a home up to $236,246.66 with the optional inputs.

Q: How do you calculate your house affordability?

A: House affordability is calculated by determining the maximum loan based on your maximum monthly payment (\( M \)), loan term (\( L \)), and interest rate (\( R \)), adjusted for optional monthly debt (\( B \)), insurance (\( N \)), and property tax (\( T \)). Use: \( A = \frac{\left(1 - \left(1 + \frac{R}{1200}\right)^{-L \times 12}\right) \times (M - B - N - T)}{\frac{R}{1200}} \). Optionally, calculate maximum home value with down payment (\( D \)) and closing costs (\( C \)): \( H = \frac{A + D}{1 + \frac{C}{100}} \).

Q: How do I determine my maximum monthly payment?

A: Estimate your maximum payment based on income, typically 28–36% of monthly gross income, minus existing debts and expected home expenses like insurance and taxes.

Q: Why include optional inputs?

A: Optional inputs like down payment and closing costs refine the maximum home value estimate, while debts, insurance, and taxes adjust the affordable loan amount to reflect total housing costs.