Home

Home

Back

Back

Definition: The Holding Period Return (HPR) is the total return earned on an investment or portfolio over the period it is held, expressed as a percentage. It includes both capital gains (or losses) and income from dividends or interest.

Purpose: HPR helps investors evaluate the performance of their investments by considering all sources of return, making it easier to compare investments held for different periods.

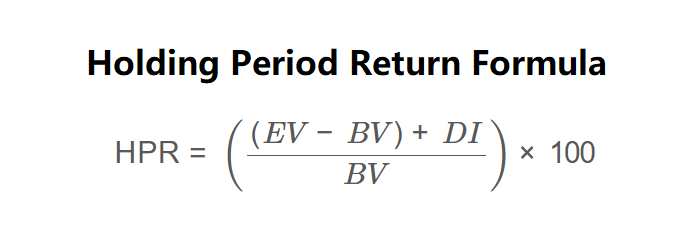

The calculator uses the following formula for Holding Period Return, as shown in the image above:

\[ \text{HPR} = \left( \frac{(EV - BV) + DI}{BV} \right) \times 100 \]

For Annualized HPR, the formula is:

\[ \text{AHPR} = \left(1 + \frac{\text{HPR}}{100}\right)^{\frac{1}{HP}} - 1 \times 100 \]

Where:

Steps:

Calculating HPR is essential for:

Example 1: Calculate the HPR for Company Alpha

Example 2: Calculate the HPR for a stock held for 2 years

Q: Why include dividend income in HPR?

A: Dividend income is a significant part of total returns for many investments, especially dividend-paying stocks, and excluding it would underestimate the investment’s performance.

Q: What does a negative HPR mean?

A: A negative HPR indicates a loss on the investment, meaning the ending value plus dividends is less than the beginning value.

Q: Why calculate annualized HPR?

A: Annualized HPR standardizes returns to an annual basis, making it easier to compare investments held for different periods.

Q: How does HPR affect taxes?

A: The holding period determines whether gains are taxed as short-term (less than 1 year) or long-term (more than 1 year), with different tax rates applying.