Home

Home

Back

Back

Definition: The High-Low Method Calculator estimates the fixed and variable components of a mixed cost by analyzing the highest and lowest levels of activity and their associated costs. It is a cost accounting technique used to separate mixed costs into variable cost per unit and total fixed cost, then predict total cost for a given production level.

Purpose: It helps businesses budget and forecast costs by understanding how costs behave with changes in production levels, especially when limited data is available. This method is useful for cost estimation, budgeting, and decision-making in financial planning.

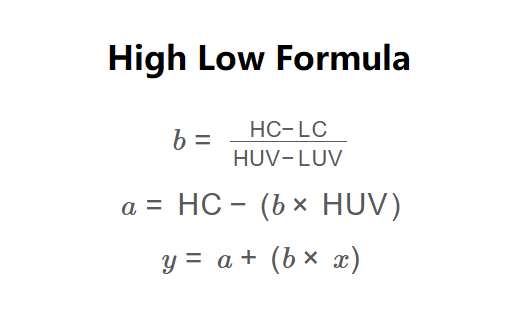

The calculator uses the following formulas, as shown in the image above:

\( b = \frac{\text{HC} - \text{LC}}{\text{HUV} - \text{LUV}} \)

\( a = \text{HC} - (b \times \text{HUV}) \)

\( y = a + (b \times x) \)

Where:

Steps:

Calculating using the High-Low Method is essential for:

Example 1: Calculate the variable cost per unit, total fixed cost, and total cost for a company with a high cost of $5,550 at 125 units, a low cost of $3,750 at 70 units, and a desired production of 100 units:

Example 2: Calculate the variable cost per unit, total fixed cost, and total cost for a company with a high cost of $60,000 at 6,000 units, a low cost of $50,000 at 4,000 units, and a desired production of 5,000 units:

Q: What is a limitation of the High-Low Method?

A: It oversimplifies cost behavior by using only two data points, potentially ignoring variations in costs at other activity levels. It assumes a linear relationship, which may not always hold true.

Q: How does the High-Low Method differ from regression analysis?

A: The High-Low Method uses only the highest and lowest data points, while regression analysis considers all data points for a more accurate cost estimation, though it requires more data and computation.

Q: Can the High-Low Method be used for all types of costs?

A: It is best suited for mixed costs (with fixed and variable components). Purely fixed or variable costs do not require this method, as they can be directly identified.