Home

Home

Back

Back

Definition: The Hedge Ratio is a financial metric that measures the proportion of an investment portfolio that is protected (or hedged) against market risks. It is expressed as a percentage of the total exposure that is covered by a hedge.

Purpose: The Hedge Ratio helps investors assess how much of their portfolio is immune to market volatility, enabling better risk management and decision-making.

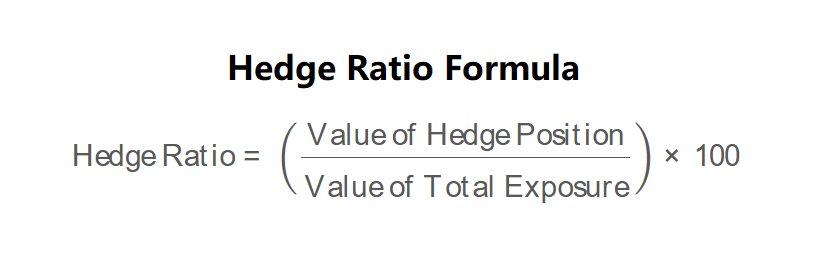

The calculator uses the following formula for Hedge Ratio, as shown in the image above:

\[ \text{Hedge Ratio} = \left( \frac{\text{Value of Hedge Position}}{\text{Value of Total Exposure}} \right) \times 100 \]

Where:

Steps:

Calculating the Hedge Ratio is essential for:

Example 1: Calculate the Hedge Ratio for a portfolio

Example 2: Calculate the Hedge Ratio for another portfolio

Q: What does a Hedge Ratio of 100% mean?

A: A Hedge Ratio of 100% means the entire portfolio is fully hedged, and all potential losses due to market risks are covered.

Q: Can the Hedge Ratio be greater than 100%?

A: No, the Hedge Ratio cannot exceed 100% in this context, as the hedge position cannot be greater than the total exposure.

Q: What does a Hedge Ratio of 0% mean?

A: A Hedge Ratio of 0% means the portfolio is completely unhedged, with no protection against market risks.

Q: Why is the Hedge Ratio important for investors?

A: It helps investors understand the level of risk protection in their portfolio, allowing them to adjust their hedging strategies to balance risk and potential returns.