Home

Home

Back

Back

Definition: The HELOC Calculator estimates the maximum Home Equity Line of Credit (HELOC) amount you may qualify for and the Combined Loan-to-Value (CLTV) ratio based on your home value, mortgage balance, and requested credit line.

Purpose: This tool helps homeowners understand how much credit they can access through a HELOC, assess their loan-to-value ratios, and evaluate eligibility based on lender requirements, typically requiring a CLTV below 80%.

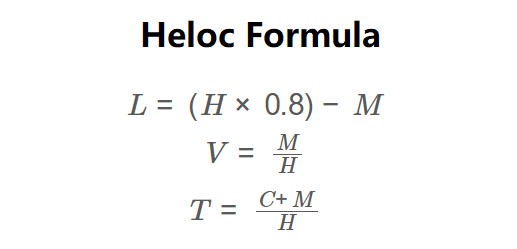

The calculator uses the following formulas:

\( L = (H \times 0.8) - M \)

\( V = \frac{M}{H} \)

\( T = \frac{C + M}{H} \)

Where:

Steps:

Calculating HELOC eligibility is essential for:

Example: Calculate the HELOC amount and CLTV for a home worth $500,000 with a $50,000 mortgage balance, requesting a $100,000 credit line:

With a CLTV of 30% (well below 80%), you are likely eligible for the requested $100,000 HELOC, assuming other requirements (e.g., credit score) are met.

Q: What is a HELOC?

A: A Home Equity Line of Credit (HELOC) is a revolving credit line secured by your home’s equity, allowing you to borrow up to a percentage of your home’s value, typically 80%.

Q: How does CLTV affect HELOC approval?

A: Lenders use CLTV to assess risk. A CLTV below 80% is typically required for approval, though other factors like credit score also matter.

Q: Can I access more than 80% of my home’s value?

A: With an excellent credit score (e.g., FICO above 720), some lenders may offer more, but 80% is the standard limit.