Home

Home

Back

Back

Definition: The Growing Annuity Calculator computes the future value of a series of cash flows that grow at a constant rate, accounting for interest earned over a specified number of periods.

Purpose: Helps investors, financial planners, and individuals estimate the future value of investments or savings with increasing payments, such as retirement contributions or escalating rent payments.

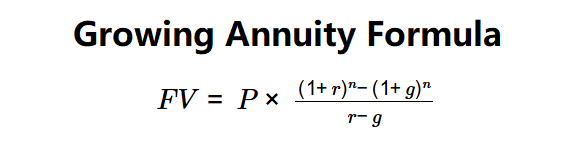

The calculator computes the future value using the following formula:

Formula:

Steps:

Calculating the future value of a growing annuity is crucial for:

Example: Periodic payment = $1000, Interest rate = 5%, Growth rate = 2%, Number of periods = 10:

This shows the future value of the growing annuity.

Q: What is a growing annuity?

A: A growing annuity is a series of payments that increase at a constant rate over time, such as contributions that rise with inflation or salary growth.

Q: Why must the interest rate differ from the growth rate?

A: If the interest rate equals the growth rate, the denominator becomes zero, making the formula undefined.

Q: Can this calculator handle withdrawals?

A: Yes, enter a negative periodic payment for withdrawals to calculate the future value of a decreasing annuity.