Home

Home

Back

Back

Definition: This calculator computes the Gross Rent Multiplier (G), the ratio of a property’s price to its gross annual rental income, used to evaluate real estate investments.

Purpose: Helps investors quickly assess the value of rental properties, compare investment opportunities, and estimate payback periods without considering operating expenses.

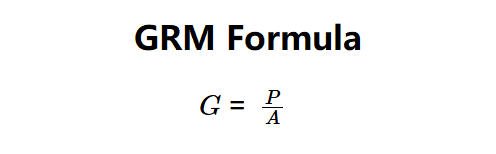

The calculator uses this formula:

Formula:

If gross rental income (\( I \)) is provided in USD/month, it is converted to annual: \( A = I \times 12 \).

Steps:

Calculating GRM is key for:

Example: For a property with \( P = \$1,000,000 \), \( I = \$95,000 \) (USD/year):

Alternatively, with \( I = \$7,916.67 \) (USD/month): \( A = 7,916.67 \times 12 = \$95,000 \), yielding the same GRM. This shows the property takes 11.76 years of gross rent to recover its price.

Q: How do you calculate the gross rent multiplier?

A: GRM is calculated in three steps: (1) Determine the property price (\( P \)), typically the asking price or market value; (2) Determine the gross annual rental income (\( A \)), either directly or by converting monthly income (\( I \)) using \( A = I \times 12 \); (3) Calculate GRM using \( G = \frac{P}{A} \). For example, a $1,000,000 property with $95,000 annual rent (or $7,916.67 monthly) yields \( G = \frac{1,000,000}{95,000} = 11.76 \).

Q: What is a good GRM?

A: A good GRM varies by market, but 8–12 is often considered reasonable. Lower GRMs suggest better investment value, while higher GRMs may indicate overpricing or lower rental income.

Q: Does GRM include expenses?

A: No, GRM uses gross rental income, excluding expenses like maintenance, taxes, or insurance, making it a quick but simplified valuation tool compared to net-based metrics like cap rate.