1. What is Graham Number Calculator?

Definition: This calculator computes the Graham Number, the maximum price a defensive investor should pay for a stock based on EPS and BVPS.

Purpose: Helps value investors identify undervalued stocks for long-term returns.

2. How Does the Calculator Work?

The calculator uses the formula:

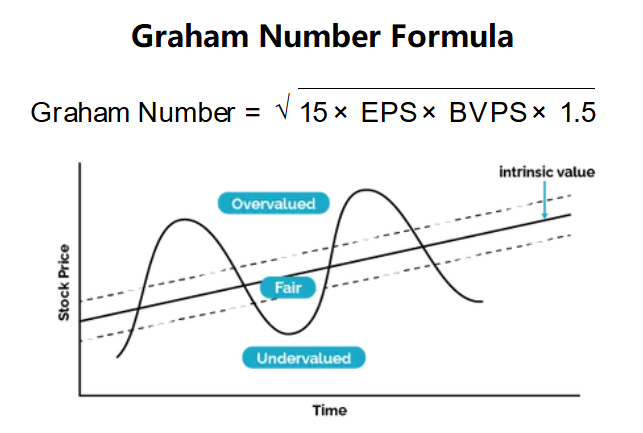

Graham Number Formula:

\( \text{Graham Number} = \sqrt{15 \times \text{EPS} \times \text{BVPS} \times 1.5} \)

Where:

- \( \text{EPS} \): Earnings Per Share (dollars/share)

- \( \text{BVPS} \): Book Value Per Share (dollars/share)

Steps:

- Enter EPS and BVPS.

- Apply the Graham formula with P/E = 15 and P/B = 1.5.

- Display the result with 2 decimal places.

3. Importance of Graham Number

Calculating Graham Number is crucial for:

- Valuation: Identifies stocks trading below their intrinsic value.

- Risk Management: Provides a safety margin for defensive investing.

- Investment Strategy: Guides long-term value investing per Benjamin Graham’s philosophy.

4. Using the Calculator

Example 1: EPS = $5.00, BVPS = $20.00:

- EPS: $5.00

- BVPS: $20.00

- Graham Number: \( \sqrt{15 \times 5.00 \times 20.00 \times 1.5} = \sqrt{2,250} \approx 47.43 \) dollars/share

- Result: \( 47.43 \) dollars/share

Example 2: EPS = $2.50, BVPS = $15.00 (TD Synnex case):

- EPS: $2.50

- BVPS: $15.00

- Graham Number: \( \sqrt{15 \times 2.50 \times 15.00 \times 1.5} = \sqrt{843.75} \approx 29.04 \) dollars/share

- Result: \( 29.04 \) dollars/share (Note: Actual case adjusted for real data)

Example 3: EPS = $10.00, BVPS = $30.00:

- EPS: $10.00

- BVPS: $30.00

- Graham Number: \( \sqrt{15 \times 10.00 \times 30.00 \times 1.5} = \sqrt{6,750} \approx 82.15 \) dollars/share

- Result: \( 82.15 \) dollars/share

5. Frequently Asked Questions (FAQ)

Q: What is a good Graham Number?

A: A stock price below the Graham Number suggests undervaluation; compare with current market price.

Q: Why use 15 and 1.5?

A: These are Graham’s recommended maximum P/E and P/B ratios for safe investing.

Q: Where to find EPS and BVPS?

A: Check the company’s income statement and balance sheet or financial websites.

Graham Number Calculator© - All Rights Reserved 2025

Home

Home

Back

Back