Home

Home

Back

Back

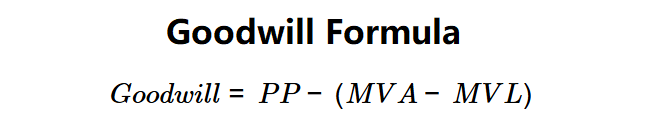

Definition: This calculator computes the goodwill (\( Goodwill \)), which represents the excess of the purchase price over the fair market value of a company's net assets (assets minus liabilities) during an acquisition.

Purpose: Helps businesses and investors determine the intangible value (e.g., brand, customer loyalty) acquired in a merger or acquisition, aiding in financial reporting and valuation.

The calculator follows a four-step process to compute goodwill:

Formula:

Steps:

Calculating goodwill is crucial for:

Example 1 (Company Alpha): \( PP = \$1,000,000 \), \( MVA = \$450,000 \), \( MVL = \$400,000 \):

A goodwill of $950,000 reflects the intangible value acquired in the purchase of Company Alpha.

Example 2: \( PP = \$2,500,000 \), \( MVA = \$1,800,000 \), \( MVL = \$1,200,000 \):

A goodwill of $1,900,000 indicates a significant intangible premium.

Example 3: \( PP = \$800,000 \), \( MVA = \$700,000 \), \( MVL = \$300,000 \):

A goodwill of $400,000 suggests a moderate intangible value addition.

Q: What is goodwill?

A: Goodwill (\( Goodwill \)) is the intangible value of a company, representing the premium paid over its net asset value during an acquisition.

Q: Why is goodwill important in acquisitions?

A: It captures the value of intangible assets like brand, customer base, or synergies, which are not reflected in tangible asset values.

Q: Can goodwill be negative?

A: No, goodwill is typically non-negative; a negative result would indicate an overvaluation error or require further financial review.