1. What is the Futures Contract Profit/Loss Calculator?

Definition: This calculator computes the point value and the profit or loss for both the buyer and seller of a futures contract based on price movements.

Purpose: Assists traders and investors in evaluating the financial outcomes of holding long or short positions in futures contracts, aiding in risk management and decision-making.

2. How Does the Calculator Work?

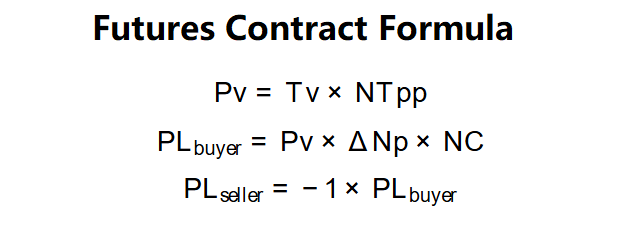

The calculator uses the following formulas to compute results:

Formulas:

\( \text{Pv} = \text{Tv} \times \text{NTpp} \)

\( \text{PL}_\text{buyer} = \text{Pv} \times \Delta \text{Np} \times \text{NC} \)

\( \text{PL}_\text{seller} = -1 \times \text{PL}_\text{buyer} \)

Where:

- \( \text{Tv} \): Tick value (USD)

- \( \text{NTpp} \): Number of ticks per point (ticks)

- \( \Delta \text{Np} \): Number of points moved (points)

- \( \text{NC} \): Number of contracts (contracts)

- \( \text{Pv} \): Point value (USD)

- \( \text{PL}_\text{buyer} \): Profit/loss for buyer (USD)

- \( \text{PL}_\text{seller} \): Profit/loss for seller (USD)

Steps:

- Step 1: Input parameters. Enter the tick value (\( \text{Tv} \)), number of ticks per point (\( \text{NTpp} \)), number of points moved (\( \Delta \text{Np} \)), and number of contracts (\( \text{NC} \)).

- Step 2: Calculate Pv. Multiply the tick value by the number of ticks per point.

- Step 3: Calculate PL_buyer. Multiply the point value by the points moved and number of contracts.

- Step 4: Calculate PL_seller. Compute the seller's profit/loss as the negative of the buyer's profit/loss.

3. Importance of Futures Contract Profit/Loss Calculation

Calculating futures contract profits/losses is crucial for:

- Trade Evaluation: Helps traders assess the financial impact of price movements in futures contracts.

- Risk Management: Enables investors to understand potential gains or losses for long and short positions.

- Strategic Planning: Supports decision-making by comparing outcomes across different contract specifications.

4. Using the Calculator

Example 1: \( \text{Tv} = \$10.00 \), \( \text{NTpp} = 100 \), \( \Delta \text{Np} = 0.25 \), \( \text{NC} = 5 \):

- Step 1: Input \( \text{Tv} = 10.00 \), \( \text{NTpp} = 100 \), \( \Delta \text{Np} = 0.25 \), \( \text{NC} = 5 \).

- Step 2: Calculate Pv: \( 10.00 \times 100 = \$1000.00 \).

- Step 3: Calculate PL_buyer: \( 1000.00 \times 0.25 \times 5 = \$1250.00 \).

- Step 4: Calculate PL_seller: \( -1 \times 1250.00 = -\$1250.00 \).

- Results: Pv = \$1000.00, PL_buyer = \$1250.00, PL_seller = -\$1250.00.

This result indicates a profit for the buyer and an equivalent loss for the seller due to the price increase.

Example 2: \( \text{Tv} = \$12.50 \), \( \text{NTpp} = 1 \), \( \Delta \text{Np} = -19 \), \( \text{NC} = 1 \):

- Step 1: Input \( \text{Tv} = 12.50 \), \( \text{NTpp} = 1 \), \( \Delta \text{Np} = -19 \), \( \text{NC} = 1 \).

- Step 2: Calculate Pv: \( 12.50 \times 1 = \$12.50 \).

- Step 3: Calculate PL_buyer: \( 12.50 \times (-19) \times 1 = -\$237.50 \).

- Step 4: Calculate PL_seller: \( -1 \times (-237.50) = \$237.50 \).

- Results: Pv = \$12.50, PL_buyer = -\$237.50, PL_seller = \$237.50.

This result shows a loss for the buyer and a profit for the seller due to the price decrease.

5. Frequently Asked Questions (FAQ)

Q: What does a negative PL_buyer indicate?

A: A negative value indicates a loss for the buyer, which corresponds to a profit for the seller.

Q: How is the tick value determined?

A: The tick value is specified in the futures contract, often based on the contract size and tick size (e.g., 1 cent/barrel).

Q: Can this calculator handle different types of futures contracts?

A: Yes, as long as you input the correct tick value, ticks per point, and other parameters specific to the contract.

Futures Contract Profit/Loss Calculator© - All Rights Reserved 2025

Home

Home

Back

Back