1. What is Free Float Calculator?

Definition: This calculator computes the number of free float shares and their percentage, representing shares available for public trading.

Purpose: Helps investors assess stock liquidity and market volatility based on available shares.

2. How Does the Calculator Work?

The calculator uses the following formulas:

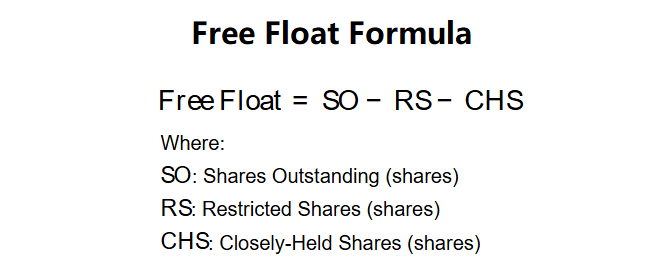

Free Float:

\( \text{Free Float} = \text{SO} - \text{RS} - \text{CHS} \)

Where:

- \( \text{SO} \): Shares Outstanding (shares)

- \( \text{RS} \): Restricted Shares (shares)

- \( \text{CHS} \): Closely-Held Shares (shares)

Free Float Percentage:

\( \text{Free Float Percentage} = \frac{\text{Free Float}}{\text{SO}} \times 100 \)

Steps:

- Enter shares outstanding, restricted shares, and closely-held shares.

- Subtract restricted and closely-held shares from total shares to get free float.

- Calculate percentage based on shares outstanding.

- Display with 0 decimal places for shares and 2 for percentage.

3. Importance of Free Float

Calculating free float is crucial for:

- Liquidity Assessment: Indicates how many shares are available for trading.

- Volatility Insight: Lower free float can lead to higher stock price volatility.

- Investment Strategy: Guides institutional investors preferring stocks with larger free float.

4. Using the Calculator

Example 1: SO = 10,000, RS = 2,000, CHS = 1,000:

- Shares Outstanding: 10,000

- Restricted Shares: 2,000

- Closely-Held Shares: 1,000

- Free Float: \( 10,000 - 2,000 - 1,000 = 7,000 \) shares

- Free Float Percentage: \( \frac{7,000}{10,000} \times 100 = 70.00\% \)

- Result: Free Float = 7,000 shares, Percentage = 70.00%

Example 2: SO = 5,000, RS = 500, CHS = 1,000:

- Shares Outstanding: 5,000

- Restricted Shares: 500

- Closely-Held Shares: 1,000

- Free Float: \( 5,000 - 500 - 1,000 = 3,500 \) shares

- Free Float Percentage: \( \frac{3,500}{5,000} \times 100 = 70.00\% \)

- Result: Free Float = 3,500 shares, Percentage = 70.00%

Example 3: SO = 20,000, RS = 5,000, CHS = 10,000:

- Shares Outstanding: 20,000

- Restricted Shares: 5,000

- Closely-Held Shares: 10,000

- Free Float: \( 20,000 - 5,000 - 10,000 = 5,000 \) shares

- Free Float Percentage: \( \frac{5,000}{20,000} \times 100 = 25.00\% \)

- Result: Free Float = 5,000 shares, Percentage = 25.00%

5. Frequently Asked Questions (FAQ)

Q: What is free float?

A: Free float is the number of shares available for public trading, excluding restricted and closely-held shares.

Q: Why is a high free float percentage good?

A: It indicates better liquidity and lower volatility, attracting institutional investors.

Q: Where to find these numbers?

A: Check the company’s balance sheet or shareholder reports for outstanding, restricted, and closely-held shares.

Home

Home

Back

Back