1. What is the Forward Rate Calculator?

Definition: This calculator computes the forward rate, which is the interest rate for a future investment period, derived from the spot rates of two different investment horizons.

Purpose: Assists investors and financial analysts in determining the implied interest rate for a future bond investment, aiding in portfolio planning and yield comparisons.

2. How Does the Calculator Work?

The calculator uses the following formula to compute the forward rate:

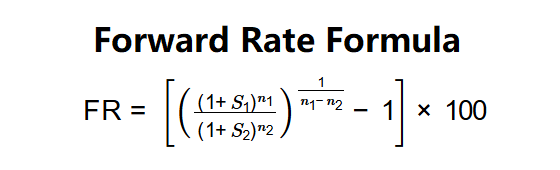

Formula:

\( \text{FR} = \left[ \left( \frac{(1 + S_1)^{n_1}}{(1 + S_2)^{n_2}} \right)^{\frac{1}{n_1 - n_2}} - 1 \right] \times 100 \)

Where:

- \( n_1 \): Time period 1, the longer investment horizon (years)

- \( S_1 \): Spot rate for time period 1 (decimal)

- \( n_2 \): Time period 2, the shorter investment horizon (years)

- \( S_2 \): Spot rate for time period 2 (decimal)

- \( \text{FR} \): Forward rate for the period from \( n_2 \) to \( n_1 \) (percentage)

Steps:

- Step 1: Input parameters. Enter the time period 1 (\( n_1 \)), spot rate for time period 1 (\( S_1 \)), time period 2 (\( n_2 \)), and spot rate for time period 2 (\( S_2 \)).

- Step 2: Calculate FR. Compute the forward rate using the formula provided.

3. Importance of Forward Rate Calculation

Calculating forward rates is crucial for:

- Investment Planning: Helps investors compare yields of different investment strategies, such as long-term vs. sequential short-term bonds.

- Yield Curve Analysis: Provides insights into future interest rate expectations.

- Risk Management: Enables better decision-making for hedging interest rate risk.

4. Using the Calculator

Example: \( n_1 = 5 \), \( S_1 = 6\% \), \( n_2 = 3 \), \( S_2 = 3\% \):

- Step 1: Input \( n_1 = 5 \), \( S_1 = 6 \), \( n_2 = 3 \), \( S_2 = 3 \).

- Step 2: Calculate FR: \( \left[ \left( \frac{(1 + 0.06)^5}{(1 + 0.03)^3} \right)^{\frac{1}{5 - 3}} - 1 \right] \times 100 \approx 10.66\% \).

- Result: FR = 10.66%.

This result indicates the implied interest rate for a 2-year bond starting 3 years from now.

5. Frequently Asked Questions (FAQ)

Q: What does the forward rate represent?

A: It is the implied interest rate for a future investment period, derived from current spot rates.

Q: Why must \( n_1 \) be greater than \( n_2 \)?

A: The forward rate is calculated for the period between \( n_2 \) and \( n_1 \), so \( n_1 \) must be the longer horizon.

Q: Where can I find spot rates?

A: Spot rates are available from financial markets, bond yield curves, or financial data providers.

Forward Rate Calculator© - All Rights Reserved 2025

Home

Home

Back

Back