1. What is the Forward Premium Calculator?

Definition: This calculator computes the forward premium and annualized forward premium for a currency pair, indicating the cost or benefit of locking in a future exchange rate via a forward contract.

Purpose: Assists traders, investors, and financial analysts in evaluating the cost of currency forward contracts, aiding in hedging and investment decisions.

2. How Does the Calculator Work?

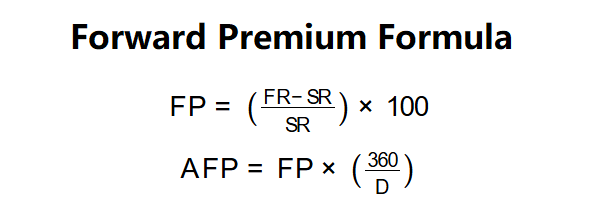

The calculator uses the following formulas to compute results:

Formulas:

\( \text{FP} = \left( \frac{\text{FR} - \text{SR}}{\text{SR}} \right) \times 100 \)

\( \text{AFP} = \text{FP} \times \left( \frac{360}{\text{D}} \right) \)

Where:

- \( \text{SR} \): Spot rate of the currency pair (rate)

- \( \text{FR} \): Forward rate of the currency pair (rate)

- \( \text{D} \): Number of days in the forward contract (days)

- \( \text{FP} \): Forward premium (percentage)

- \( \text{AFP} \): Annualized forward premium (percentage)

Steps:

- Step 1: Input parameters. Enter the spot rate (\( \text{SR} \)), forward rate (\( \text{FR} \)), and number of days (\( \text{D} \)).

- Step 2: Calculate FP. Compute the forward premium using the formula provided.

- Step 3: Calculate AFP. Compute the annualized forward premium by scaling the forward premium.

3. Importance of Forward Premium Calculation

Calculating forward premiums is crucial for:

- Hedging Decisions: Helps businesses and investors assess the cost of locking in future exchange rates.

- Market Analysis: Indicates expectations of currency appreciation or depreciation.

- Cost Management: Enables comparison of forward contract costs across different time periods.

4. Using the Calculator

Example: \( \text{SR} = 1.1859 \), \( \text{FR} = 1.1885 \), \( \text{D} = 90 \):

- Step 1: Input \( \text{SR} = 1.1859 \), \( \text{FR} = 1.1885 \), \( \text{D} = 90 \).

- Step 2: Calculate FP: \( \left( \frac{1.1885 - 1.1859}{1.1859} \right) \times 100 \approx 0.22\% \).

- Step 3: Calculate AFP: \( 0.22 \times \left( \frac{360}{90} \right) \approx 0.88\% \).

- Results: FP = 0.22%, AFP = 0.88%.

These results suggest a small premium for locking in the GBP/EUR forward rate, annualized to reflect a yearly cost.

5. Frequently Asked Questions (FAQ)

Q: What does a positive forward premium indicate?

A: It suggests the forward rate is higher than the spot rate, implying expected appreciation of the base currency.

Q: Why use 360 days for annualization?

A: The 360-day convention is commonly used in financial markets for simplicity.

Q: Where can I find spot and forward rates?

A: Spot and forward rates are available from financial news sources, banks, or forex platforms.

Forward Premium Calculator© - All Rights Reserved 2025

Home

Home

Back

Back