Home

Home

Back

Back

Definition: This calculator computes the fixed asset turnover ratio (\( FAT \)), which measures how efficiently a company uses its fixed assets to generate revenue, indicating asset utilization.

Purpose: Helps businesses, investors, and analysts assess the productivity of fixed assets and evaluate operational efficiency.

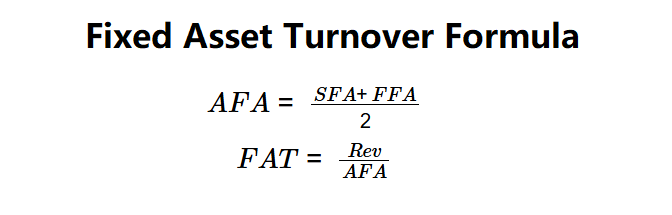

The calculator follows a three-step process to compute the fixed asset turnover ratio:

Formulas:

Steps:

Calculating the fixed asset turnover ratio is crucial for:

Example 1 (Company Alpha): \( SFA = \$15,000,000 \), \( FFA = \$18,000,000 \), \( Rev = \$7,500,000 \):

A fixed asset turnover of 0.45x suggests moderate asset utilization.

Example 2: \( SFA = \$10,000,000 \), \( FFA = \$12,000,000 \), \( Rev = \$9,000,000 \):

A fixed asset turnover of 0.82x indicates better asset efficiency.

Example 3: \( SFA = \$5,000,000 \), \( FFA = \$7,000,000 \), \( Rev = \$2,000,000 \):

A fixed asset turnover of 0.33x suggests lower asset productivity.

Q: What is the fixed asset turnover ratio?

A: The fixed asset turnover ratio (\( FAT \)) measures how effectively a company uses its fixed assets to generate revenue.

Q: What does a low fixed asset turnover indicate?

A: A low \( FAT \) may suggest underutilized assets or overinvestment in fixed assets.

Q: Can the fixed asset turnover be negative?

A: No, since revenue and average fixed assets are non-negative, \( FAT \) is non-negative.