Home

Home

Back

Back

Definition: The Fisher Equation Calculator determines the real interest rate using either the approximate or exact formula, adjusting the nominal interest rate for expected inflation

Purpose: Helps investors and economists assess the true cost of borrowing or return on investment, accounting for inflation in economic conditions.

The calculator computes the real interest rate using the following formulas and steps:

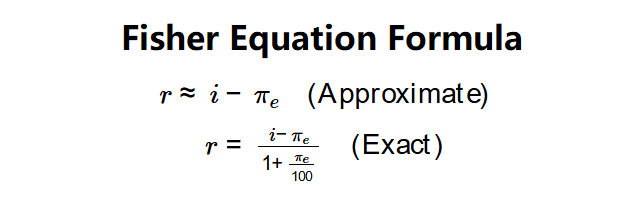

Formulas:

Steps:

Calculating the Fisher equation is crucial for:

Example: Nominal interest rate = 5%, Expected inflation = 2%, Method = Approximate:

Example (Exact): Nominal interest rate = 5%, Expected inflation = 2%, Method = Exact:

These results reflect the real return on a loan or investment after accounting for 2% inflation as of July 03, 2025.

Q: What is the Fisher equation?

A: The Fisher equation relates nominal interest rate (\( i \)), real interest rate (\( r \)), and expected inflation (\( \pi_e \)), with approximate (\( r \approx i - \pi_e \)) and exact (\( r = \frac{i - \pi_e}{1 + \frac{\pi_e}{100}} \)) forms.

Q: Why use the exact formula?

A: The exact formula accounts for the compounding effect of inflation, providing a more precise real rate, especially at higher inflation levels.

Q: Can the real interest rate be negative?

A: Yes, if inflation exceeds the nominal rate (e.g., 5% nominal, 6% inflation = -1% real rate).