Home

Home

Back

Back

Definition: The Fisher Effect Calculator determines the real interest rate by adjusting the nominal interest rate for expected inflation

Purpose: Helps investors and economists assess the true cost of borrowing or return on investment after accounting for inflation in economic conditions.

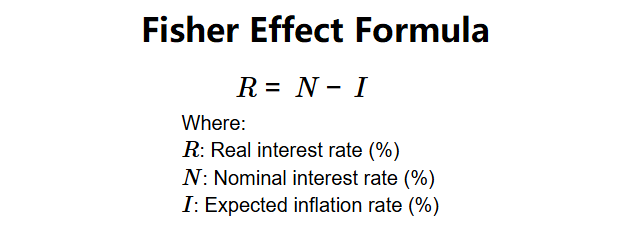

The calculator computes the real interest rate using the following formula and steps:

Formula:

Steps:

Calculating the Fisher effect is crucial for:

Example: Nominal interest rate = 5%, Expected inflation = 2%:

This indicates the real return on a loan or investment after accounting for 2% inflation as of July 03, 2025.

Q: What is the Fisher effect?

A: The Fisher effect describes the relationship between nominal interest rates, real interest rates, and expected inflation, stating \( R = N - I \).

Q: Why is the real interest rate important?

A: It reflects the true purchasing power gain or cost, excluding inflation’s impact, crucial for 2025 financial planning.

Q: Can the real interest rate be negative?

A: Yes, if inflation exceeds the nominal rate (e.g., 5% nominal, 6% inflation = -1% real rate).