Home

Home

Back

Back

Definition: The Finance Charge Calculator estimates the interest cost (finance charge) on a credit card or other credit-based financial instrument for a given billing cycle, based on the carried unpaid balance, Annual Percentage Rate (APR), and billing cycle length. It also calculates the new opening balance for the next billing cycle.

Purpose: This tool helps users understand the cost of carrying a credit balance and the resulting new balance, aiding in budgeting and debt management decisions.

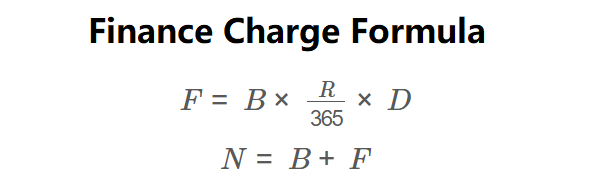

The calculator uses the following formulas:

\( F = B \times \frac{R}{365} \times D \)

\( N = B + F \)

Where:

Steps:

Calculating the finance charge and new opening balance is essential for:

Example: Calculate the finance charge and new opening balance for a $1,000 credit card balance with an 18% APR and a 30-day billing cycle:

Q: What is a finance charge?

A: A finance charge is the interest cost charged on a credit card or loan balance for a billing cycle, based on the unpaid balance and interest rate.

Q: What is the new opening balance?

A: The new opening balance is the carried unpaid balance plus the finance charge, representing the starting balance for the next billing cycle if no payments are made.

Q: How can I reduce my finance charge?

A: Pay off your balance in full each month, reduce your carried balance, or choose a card with a lower APR.